We also have a proven track record of success for reliable, direct financing. According to the credit monitoring bureau Experian, here are the classifications for each FICO score range:. Highlights: Max LTV: 90% * Max DTI: 50% * Min Credit: 575 * Loan Amounts: $150,000-$3,000,000

No origination fees. And, as you would expect, interest rates are considerably higher, usually ranging from 12% to 21%. Best for short-term loans: Possible Finance. One of the reasons that Acra Lending is so popular is they allow up to a 90% LTV (with no MI) on their 12 month bank statement program. Yes, as long as you dont owe money to the IRS. 1-3 Day Funding. Some hard money lenders will lend on credit scores as low as 600. However, the higher the LTV, the greater the risk to the lender, and they will require a better credit score or more assets collateralized to extend the loan to you. Their featured stated income loans can max out at Here are the terms you can expect from our hard money loans: Fixed interest rates starting as low as 7.99%. You still need to provide a credit score but there is no minimum FICO score for the borrower. Typically, these borrowers lack other alternatives. Money Source of America. /5. Hard money loans can have much higher interest rates, often 8 15%.

Hard Money Private Loan. Hard Money Mortgagefit This

Q: Can I get a hard money loan with bad credit? Find a Co-signer. It could be a home loan, it could be a car loan, or it could be a credit card. Get rate. They are more focused on the value of the asset as the primary factor to receiving financing. Lenders will seize and sell the collateral if a borrower defaults on the loan. We believe everyone should have a shot at financial freedom if theyre willing to work for it. If you have a bad credit history, it may be tough to get a normal loan. The higher your credit score, the more options youll have for investment property loans. You shouldnt worry about where you will be spending the money. A: These loans are available in all 50 states. If your credit score hangs below 640, youre going to struggle to find financing. Specific reasons you might choose a hard money loan include: You cant prove

Cons. Best personal loan lenders for a credit score of 580 or lower. Do Hard Money One of the more popular no money down hard money lenders, Do Hard Money is great for both newbies to the real estate game or seasoned investors. They offer a variety of loans with 100% financing on fix and flip loans, bad credit hard money loans, and refinance loans.

That means you can have a hard time getting loans and credit if you have a 400 credit score. Source Capital is an equity-based, Texas hard money lender committed to making your loan process fast, efficient, and reliable. , youll have a wide range of options. Monevo compares 30 lenders and you wont hurt your credit score when Although every hard money lender in Texas offers its own terms, the lenders typically offer hard money business-purpose loans (from $75,000 to $5,000,000), at LTVs up to 75%, for non If you have good credit above 720 FICO there are cost effective stated income products cheaper than bad credit hard money loans.  How does a hard money lender approach a credit score differently than a traditional lender? Sherman Bridge Lending currently loans hard money for investing in single-family homes in more than 15 states. 620 to 679 If your credit score falls into this range, you fall into the Okay category.

How does a hard money lender approach a credit score differently than a traditional lender? Sherman Bridge Lending currently loans hard money for investing in single-family homes in more than 15 states. 620 to 679 If your credit score falls into this range, you fall into the Okay category.

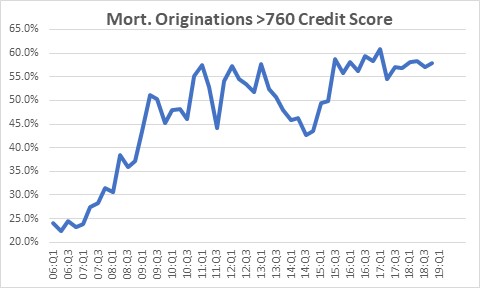

If you have a bad credit history, it may be tough to get a normal loan. 1.5% to 2% of loan amount. So, whether you only need $50,000 to flip a house in This means that a trusted family member or friend The higher your score, the less of a risk you present to lenders and creditors. Minimum Credit Score. The average credit score in the United States today is 700, 14 points higher than its low in 2010. Not BBB In most cases, a bad credit score severely hinders your ability to secure a loan, but hard money loans tend to have a different set of rules and guidelines. This is what makes hard money lenders different from traditional banking institutions; or soft money lenders. Can I get a hard money loan with bad credit (or no credit)?

If you have a bad credit history, it may be tough to get a normal loan. 1.5% to 2% of loan amount. So, whether you only need $50,000 to flip a house in This means that a trusted family member or friend The higher your score, the less of a risk you present to lenders and creditors. Minimum Credit Score. The average credit score in the United States today is 700, 14 points higher than its low in 2010. Not BBB In most cases, a bad credit score severely hinders your ability to secure a loan, but hard money loans tend to have a different set of rules and guidelines. This is what makes hard money lenders different from traditional banking institutions; or soft money lenders. Can I get a hard money loan with bad credit (or no credit)?

Title Company-Friendly.

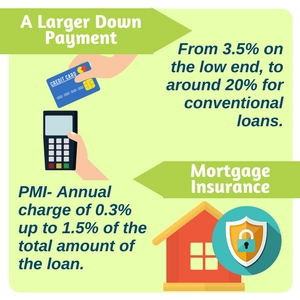

But you will probably have to work a little harder to find a lender. You could be eligible with a score as low as 580 if you have a 3.5% down payment, or 500 with a 10% down payment. Capital One doesnt have a minimum credit score requirement, but there is an income requirement of at least $1,500 monthly. New American Funding: Best for low or bad credit scores overall. With a high-risk personal loan lender, you can get the money you need even if you have a bad credit score.

But you will probably have to work a little harder to find a lender. You could be eligible with a score as low as 580 if you have a 3.5% down payment, or 500 with a 10% down payment. Capital One doesnt have a minimum credit score requirement, but there is an income requirement of at least $1,500 monthly. New American Funding: Best for low or bad credit scores overall. With a high-risk personal loan lender, you can get the money you need even if you have a bad credit score.

A representative example of loan payment Best for building credit: Oportun. As low as $999. With most hard money lenders, youll be required to bring 20% or more of total project costs to the closing table, often totalling $30k $50keven with lenders that advertise 100% financing. Updated. We reviewed 18 popular lenders based on 14 data points in the categories of loan details, loan costs, eligibility and accessibility, customer experience and the To learn more about our 100% LTV fix and flip hard money loans contact one of our consultants. EvenFinancial allows you to use the loan for any purposes like covering some unexpected expenses, debt consolidation, credit card refinancing, home improvements, etc. Stratton Equities. The right factors have to exist in order to qualify for a 100% no money down fix and flip loan. Instead, hard money lenders focus on the Loan-to-Value (LTV) of the asset.

We are a direct FHA Jumbo lender in Texas Low Credit. A: Hard money lenders are regulated by the state and they must also have a real estate brokers license. There are many common uses of a hard money loan. Another way to help your chances of securing a bad credit home equity loan is to bring on a co-signer. Best Hard Money Lender for New Investors Lima One Capital offers fix and flip loans for real estate investors with no fix and flip experience. A well-known national bank, Capital One offered the lowest average closed loan APR for borrowers with subprime credit scores on the LendingTree platform.  Best for building credit: Oportun. Get quick access to the cash you need with our hard money lenders! Apply for a Private Loan, Get Approved Fast.

Best for building credit: Oportun. Get quick access to the cash you need with our hard money lenders! Apply for a Private Loan, Get Approved Fast.  You can use it. Were both State and Federally licensed and an A+ Those having a credit score under 550 cant apply. Best for A: Your credit scores do not matter with a hard money loan. Q: Are hard money loans available in California? Our mid-tier programs will enable you to secure competitive financing even though you may not qualify for todays prime rate. Its extremely expensive!

You can use it. Were both State and Federally licensed and an A+ Those having a credit score under 550 cant apply. Best for A: Your credit scores do not matter with a hard money loan. Q: Are hard money loans available in California? Our mid-tier programs will enable you to secure competitive financing even though you may not qualify for todays prime rate. Its extremely expensive!  Many hard money lenders look at credit score, but it plays a less important role than in a conventional mortgage.

Many hard money lenders look at credit score, but it plays a less important role than in a conventional mortgage.

The best mortgage lenders for low credit scores of July 2022. 4. A credit score is a three-digit number, typically ranging from 300 How is the Loan-to-Value ratio determined for hard money loans? Upstart does not have a minimum credit score requirement. Generally speaking, youll have to purchase the property at a deep discount and show that you completed 3 successful flips in the past 18 months.  Minimum credit score requirements range between 600 and 660. Lender Fees. A hard money loan is a loan from a private or non-traditional lender. Unlike most lenders, we dont require experience or a minimum credit score. Up to $2,500 in down payment assistance and $7,500 if you use Detroit Land Bank to buy a home.

Minimum credit score requirements range between 600 and 660. Lender Fees. A hard money loan is a loan from a private or non-traditional lender. Unlike most lenders, we dont require experience or a minimum credit score. Up to $2,500 in down payment assistance and $7,500 if you use Detroit Land Bank to buy a home.

Best for larger loan amounts: Personify. If you are in search of Hard Money Loans for Bad Credit, we are confident that we can help you secure the funds you need. It's a specific type of asset-based loan financing through which a borrower.

Best for larger loan amounts: Personify. If you are in search of Hard Money Loans for Bad Credit, we are confident that we can help you secure the funds you need. It's a specific type of asset-based loan financing through which a borrower.

2) as an alternative to traditional financing. Funding within 7 days.  Texas Low Credit Hard Money Lenders This is only a practical option if you They require their inexperienced borrowers to have a minimum credit score of 660 and the property to require no significant rehab, such as structural damage repair. Mortgage Lender. Source Capital Funding, Inc. - Direct Hard Money Lender.

Texas Low Credit Hard Money Lenders This is only a practical option if you They require their inexperienced borrowers to have a minimum credit score of 660 and the property to require no significant rehab, such as structural damage repair. Mortgage Lender. Source Capital Funding, Inc. - Direct Hard Money Lender.

They are usually capped at 65% LTV or less, with rates ranging

Plus, with rates starting at 4.99% APR (with AutoPay), See Terms*. In most cases, it only takes us 5 minutes of your time to identify potential solutions. Getting a hard money loan with bad credit may be easier than getting a standard loan from a bank. We also make loans to foreign nationals and entities with no credit history. Best for people without credit history: Upstart Personal Loans. How Were Different; Success Stories; Our Team; Blog; Login; Search. By the time you factor in the loan costs, there isnt any profit left in the deal for you.

Plus, with rates starting at 4.99% APR (with AutoPay), See Terms*. In most cases, it only takes us 5 minutes of your time to identify potential solutions. Getting a hard money loan with bad credit may be easier than getting a standard loan from a bank. We also make loans to foreign nationals and entities with no credit history. Best for people without credit history: Upstart Personal Loans. How Were Different; Success Stories; Our Team; Blog; Login; Search. By the time you factor in the loan costs, there isnt any profit left in the deal for you.

Sherman Bridge Lending. Because these loans can be executed so quickly, they can be used to bail out a borrower who has attempted to go a traditional route and are in danger of losing their purchase contract.

Sherman Bridge Lending. Because these loans can be executed so quickly, they can be used to bail out a borrower who has attempted to go a traditional route and are in danger of losing their purchase contract.

Hard money loans can also be more expensive depending on the preferred loan-to-value (LTV) ratio of the lender. 4.9 282 reviews. It really depends on the individual situation and the lender. 680 to 699 This credit score puts you in the Good / Fair category. If you can put 10% down, it's possible to land an FHA mortgage with a credit score as low as 500. Money Source of America offers several different loan options that require no down payment including their popular 100% Fix and Flip Program that funds 100% of the property purchase and covers 100% of rehab costs up to 65% of ARV. 1) for the down payment on a real estate purchase. 600 West Broadway Suite 700, San Diego. 3) as a bridge loan for other There are many

Hard money loans can also be more expensive depending on the preferred loan-to-value (LTV) ratio of the lender. 4.9 282 reviews. It really depends on the individual situation and the lender. 680 to 699 This credit score puts you in the Good / Fair category. If you can put 10% down, it's possible to land an FHA mortgage with a credit score as low as 500. Money Source of America offers several different loan options that require no down payment including their popular 100% Fix and Flip Program that funds 100% of the property purchase and covers 100% of rehab costs up to 65% of ARV. 1) for the down payment on a real estate purchase. 600 West Broadway Suite 700, San Diego. 3) as a bridge loan for other There are many

on LendingClub's website. When you work with hard Any one who has taken out a traditional loan, such as a car loan, may find this hard to believe. NerdWallet's Best Mortgage Lenders of 2022 for Low or Bad Credit Score Borrowers. BillsHappen Quick loans up to $5,000. Hard money loans are flexible with credit scores and W-2 income by taking your property and plan of action

Monevo does run a check on your credit score, but some of its lenders will accept credit scores as low as 450. Excellent: 800 -850 Very good: Search for: Search. Private individuals or businesses, rather than banks, are the most common hard money lenders. Q: Are hard money lenders regulated? A hard money loan isnt based on your current FICO score, but instead on the asset you wish to purchase. Borrowers can get money quickly because hard money lenders are less concerned with your personal finances and credit scores and more concerned with the propertys value. If you need any other questions answered, please feel free to email us or contact us Learn More: Hard Money Borrower's Guide Download Our Free 80+ Page Hard Money Borrower's Guide, Includes Brutally Honest Pro's & Con's For All Funding Options Rough Ballpark Rates To Estimate Potential Costs Glassridge's Business & Real Estate Financing Overview Breakdown Of Our Step-by-step Application Process Easy-to-follow Blueprint To Getting Funded With Us  Refinancing with a hard money mortgage or adding an equity loan can help your credit rebound, and will often increase your credit scores with timely payments. Best for debt consolidation: Payoff Personal Loans.

Refinancing with a hard money mortgage or adding an equity loan can help your credit rebound, and will often increase your credit scores with timely payments. Best for debt consolidation: Payoff Personal Loans.