Let us not forget that this represents much more than a new legal framework, it is an important step towards reallocating capital towards the ecological transition and social issues.

MIFID II currently provides that when an investment firm offers investment advice or portfolio management services to a client, it is first required to obtain information on (among other things): (i) the client's investment objectives (i.e.

No personal information is shared with third parties.

The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay.

714 0 obj

1 Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organizational requirements and operating conditions for investment firms.

On 27 January 2022, ESMA opened a consultation on the draft guidelines which address the inclusion of sustainability preferences in a clients suitability assessment from a practical perspective. Where a client does not answer the question whether he has sustainability preferences or answers no, the firm may consider this client as sustainability-neutral and recommend products both with and without sustainability-related features. These cookies allow us to advertise our products to you and allow us to pass this information on to our trusted third parties so that they can advertise our products to you on our behalf. At BNPP AM, we have been using our proprietary scoring methodology since 2018, covering more than 13 000 issuers, to gather data on various ESG criteria, which we complete with information from other sources. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk. The market opportunity in U.S. residential mortgage-backed securities, Credit Indices Evolve with Enhanced Data Inputs, For institutional investors, ETFs can make meeting liquidity needs easier, Gold: the most effective commodity investment, 2021 Investment Outlook | Investing Beyond the Pandemic: A Reset for Portfolios, Ten ways retirement plan professionals add value to plan sponsors.

financial objectives); and (ii) the client's risk tolerances, in order to be able to recommend suitable investments.

Discover how EY insights and services are helping to reframe the future of your industry. No Alignment with SFDR Categorisations

Discover how EY insights and services are helping to reframe the future of your industry. No Alignment with SFDR Categorisations

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity.

They integrate sustainability issues and considerations into the following EU legislative regimes: The Delegated Acts complement the obligations in Regulation (EU) 2019/2088("SFDR") and Regulation (EU) 2020/852("Taxonomy Regulation") and form part of the European Commission's 'ambitious and comprehensive' package of measures to help improve the flow of money towards sustainable activities across the EU.

Like any major upheaval, the transition will take place over time and require the help of all stakeholders: Distributors, asset managers, regulators and of course investors.

We advocate the use of digital paths, for a streamlined, simplified experience connected to the portfolio construction algorithms.

It is essential that their completion leads to an inspiring exchange of information between client and adviser, rather than being an administrative formality.

0000004566 00000 n Pierre Moulin is global head of products and strategic Marketing at BNP Paribas Asset Management, based in Paris.

endstream For more information about our organization, please visit ey.com.

endobj

Click on the different category headings to find out more and change our default settings.

<<6DB97BE198B4B2110A00309DA491FE7F>]/Prev 78207/XRefStm 1175>>

Front office staff should also have the necessary knowledge and competence with regards to the criteria of the sustainability preferences and should be able to explain them to clients in non- technical terms. We welcome and will contribute to regulators' efforts to increase the transparency of available information, and actively engage with policymakers and governments to help them shape the markets we invest in and the rules that guide and govern corporate behavior. Where a firm intends to recommend a product that does not meet the initial sustainability preferences of the client in the context of investment advice, it can only do so once the client has adapted his/her sustainability preferences.

Shantanu Naravane,Senior Associate,Herbert Smith Freehills LLP, Moderator: While much progress has already been made, there is further to go, not least to improve the quality and access of companies' ESG data.

Marina Reason,Partner,Herbert Smith Freehills LLP

Heike Schmitz,Partner,Herbert Smith Freehills LLP

<.

Firms inability to meet end investors sustainable needs: due to the required assessment granularity and the requirement to ask clients for minimum percentages of sustainable investments, firms may not be in a position to match products to clients preferences.

Doubts also remain in relation to potential repercussions of classifying clients with no sustainability preference as sustainable neutral. The decision of the client should be documented. Speakers:

Doubts also remain in relation to potential repercussions of classifying clients with no sustainability preference as sustainable neutral. The decision of the client should be documented. Speakers:

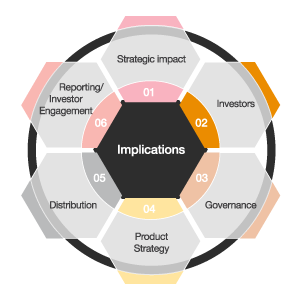

The revision of the European Unions MiFID II directive taking effect this August and requiring investment firms to assess clients sustainability preferences sets a regulatory priority that will impact asset management professionals in 2022 and beyond. 0000006314 00000 n In this new paradigm, the asset management industry plays a critical role: That of proposing a complete offering corresponding to the entire range of investor profiles, not only in terms of ESG preferences, but also risk appetite, portfolio diversification, liquidity, etc. Guidelines on certain aspects of the MiFID II suitability, Commission Delegated Regulation (EU) 2021/1253 of 21, April 2021 amending Delegated Regulation (EU) 2017/565, as regards the integration of sustainability factors, risks and, preferences into certain organizational requirements and, operating conditions for investment firms, The clients knowledge and experience in the investment field relevant to the specific type of product or service, The persons financial situation including their ability to bear losses and, Their investment objectives including their risk tolerance so as to enable the investment firm to recommend to the client or potential client the investment services and financial instruments that are suitable for him/her and, in particular, that are in accordance with their risk tolerance and ability to bear losses, Detailed reporting requirements applicable to investment products, which will become applicable as from 1 January 2023, Reporting of taxonomy-alignment by companies in scope of the Non-Financial Reporting Directive, which will become applicable as from 1 January 2023 for non-financial undertakings and from 1 January 2024 for financial undertakings, Whether the client has any sustainability preferences, If so, to what extent the client has sustainability preferences with regard to (a) environmentally sustainable investments,(b) sustainable investments and (c) financial instruments that consider principal adverse impacts (PAIs), For aspects a) and b), what are the clients preferences in terms of minimum proportion, For aspect c), which PAIs should be considered including quantitative and qualitative criteria demonstrating that consideration, Whether the client has a focus on either environmental, social or governance criteria or a combination of them or whether the client does not have such a focus, Which part of the portfolio (if any) the client wants to be invested in products meeting the clients sustainability preferences. The introduction of MiFID 2 rules should make sustainable funds even more attractive, but we will have to ensure that we maintain a balanced allocation of capital to avoid excessive concentration of investments.

EY EMEIA FSO Business Consulting Senior Manager. In total, there are five Commission Delegated Regulations and two Commission Delegated Directives (collectively the "Delegated Acts"). MiFID ESG Changes

What do sustainability preferences mean for product governance and the product manufacturers target market concepts?

Each distributor must draw up a questionnaire.

683 0 obj

This exposure provides us with a 360-degree perspective as to how fund industry leaders are approaching ESG and we are therefore very well-positioned to action customised mandates for services incorporating ESG for managers of all sizes and across the spectrum of strategies. 0000005166 00000 n In effect, only the more materially ESG-focused products will be eligible for recommendation to the clients who express clear sustainability preferences.

However, matching financial products to what could be highly specific and aspirational preferences could be quite a challenge and it may, therefore, be quite difficult to design a financial product that is fully 'sustainability preferences' eligible in all cases.

Subscribe to receive this weeks articles straight to your inbox. These cookies are necessary for the website to function and cannot be switched off in our systems.

0000001370 00000 n

0000016265 00000 n

0000026475 00000 n remember settings),Performance cookiesto measure the website's performance and improve your experience,Advertising/Targeting cookies, which are set by third parties with whom we execute advertising campaigns and allow us to provide you with advertisements relevant to you,Social media cookies, which allow you to share the content on this website on social media like Facebook and Twitter.

713 0 obj

Thomas Harding,Associate V.P.,Regulatory Solutions Lead,ISS ESG

Starting in August, advisers and distributors of financial products will have to ask clients to specify their sustainable development investment preferences as part of the European agenda to direct capital to companies most active in the transition to a low carbon and inclusive economy.

How do you move long-term value creation from ambition to action? You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website. While we welcome the progress resulting from this regulatory framework, the order of the regulations could have been better: If first companies disclose their ESG data in a transparent and harmonised way, asset managers can use them in the construction of their fund offerings, and finally distributors can assess investor preferences for sustainable investments.

These questionnaires have yet to be finalized, although we hope that distributors will have some discretion in their construction.

Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions). 0000000936 00000 n In order to help clients to understand the choices to be made in this context, staff should be able to explain therelevant concepts, the distinction between the different elements of the definition of sustainability preferences, but also between these products and products without such sustainability features in a clear manner. All Rights Reserved. Case 2 - The investment firm cannot meet the clients sustainability preferences.