India News | GST Complicated, Uniform Tax System Not Right for India: Kejriwal at Traders' Meet in Gujarat. The advertisement sector will be subject to higher tax, which will move from the current 15% to 18% under the GST regime, leading to brands ending up paying more.

Sale of space for advertisement in bill boards, public places (including stadia), buildings, conveyances, cell phones, automated teller machines, internet. 3uhvv 5hohdvh 6hoolqj ri 6sdfh iru dgyhuwlvhphqw lq sulqw phgld 4xhu\ kdv ehhq udlvhg ehiruh wklv 0lqlvwu\ uhjduglqj *67 dssolfdeoh rq vhoolqj ri

Home 10 Key Gst Amendments With Effect From 01 01 2022 V J M 10 Key Gst Amendments With Effect From 01 01 2022 V J M. NoName Jul 26, 2022.

HS Code.

JAMMU, APRIL 07:In a significant decision aimed at extending substantial financial benefit to the print and the electronic media in the State, the Finance Department today ordered that GST chargeable on advertisement bills shall be paid by the government and it would be over and above the actual advertisement rate charged by the concerned media. The average cost of advertising in a local newspaper can range between $600 to $3500 for a full-page ad based on the day of the advertisement and the amount of circulation the newspaper gets on a certain day.

This allows the access to a specific and smaller-size audience as well, including those in remote geographical locations. There can be a variety of things that can be included in this, depending on what goals youre looking for. Newspapers offer the best channel to directly get in front of an affluent, educated audience ready to spend some money.

If the advertisement agency works on principal to principal basis, that is; buys space from the newspaper and sells such space for advertisement to clients on its own account, that is, as a principal, it would be liable to pay GST @ 5% on the full amount charged by advertisement

GST Registration Process In India - 45 Questions Answered!.

Description. A lot of people take action after seeing a newspaper ad, especially an insert - 30% of users in one study went online

Srinagar 14 C Clear. WHATSAPP.

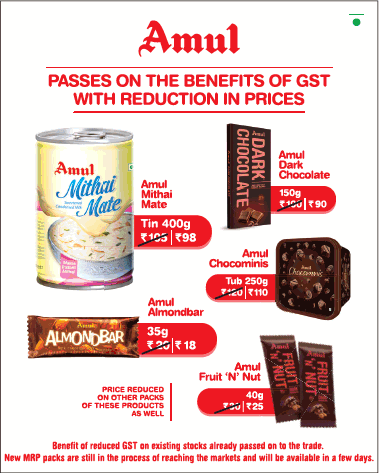

The products on which GST rates might be increased include handbags, perfumes/deodorants, chocolates, chewing gums, apparel & clothing accessories of leather, and walnuts, among others. Leave a Reply Cancel reply. 31.10.1996.

The products on which GST rates might be increased include handbags, perfumes/deodorants, chocolates, chewing gums, apparel & clothing accessories of leather, and walnuts, among others. Leave a Reply Cancel reply. 31.10.1996.  Advertising services and provision of advertising space or time.

Advertising services and provision of advertising space or time.

Where advertisement services are taken from Google entity registered under GST in India, the same is liable to GST @ 18% and a GST invoice is also required to be issued by Google.

HSN Code 4902. In the case of newspapers and publishers the amount payable for publishing an advertisement in all editions of a newspaper or publication, which are published in a State or Union Territory is the value of advertisement attributable to the dissemination in such State or Union territory. The online advertising is performing well in India at a rate of 14% growth annually and it has touched $1 billion industry in 2016-2017.  #CASansaar #GSTOverview of GST on Advertisement Services | GST on Advertising Sector discussed by CA.

#CASansaar #GSTOverview of GST on Advertisement Services | GST on Advertising Sector discussed by CA.

'5%, 18% GST applicable on selling advertisement space in print' | Business Standard News The government on Wednesday clarified that selling of space for advertisements in print media would attract 5 and 18 per cent Goods and Services Tax (GST), depending on the terms of the contract between the newspaper, advertisement agency and the Home Markets  Services Accounting Codes (SAC Codes) 998361 is used for the Advertising Services under Goods and Service Tax classification.

Services Accounting Codes (SAC Codes) 998361 is used for the Advertising Services under Goods and Service Tax classification.

# 9999999999 Email: [emailprotected] O9: Req. Instead of removing the 17% GST on solar panels they should encourage local production of solar panels.  exp. Payment of advertising charges to ad agency for display of digital on pillars 4. This $3,000 payment is for the advertisement in the next 3 months which is in December, January, and February. On this page: Media Sales Media Planning Creative & Production Sales Media Sales Ad Code Responsive Advertisement.

exp. Payment of advertising charges to ad agency for display of digital on pillars 4. This $3,000 payment is for the advertisement in the next 3 months which is in December, January, and February. On this page: Media Sales Media Planning Creative & Production Sales Media Sales Ad Code Responsive Advertisement.

GST RATE ON SAC CODE - 998361 IS 18%.

It sells space on its newspaper to a business entity. With this depending on how many subscribers or readers the publications have, it is a potential investment for an entrepreneur. Automated News Feed Subreddit No Censorship, Just News. Expense not eligible specifically mentioned in 17 (5).

Hence, an ad in the newspaper will allow advertisers to target specific demographics that are harder to reach. Inspires Action.

GST is leviable on advertisements in print media @ 5%. GST tax on Newspaper under HSN chapter 4902. In respect of a sale of advertisement space in the form of print media consisting of newspapers, magazines and journals, GST on advertisement is chargeable at 5%.

The PAN is verified on the GST Portal. Swastika Das Sharma.

Additionally, higher taxes on inputs for processed grains, pulses and dairy, which account for almost 20 per cent of the CPI basket, will put further upward pressure on consumer prices, he said. Business Categories; Events/Seasons Wagh-Bakri-Tea-Group-welcomes-GST. .jpg) According to the Commercial Taxes Department, in view of the latest order issued by the Finance Department regarding GST, the Government shall have to provide additional funds to the tune of Rs 1.75 crore to the Information Department for the year 2018-19 to be reimbursed to the newspapers as GST @ 5%, which will be over and above the Rs 35 crore advertisement GST is essentially a tax only on the value addition at each stage.

According to the Commercial Taxes Department, in view of the latest order issued by the Finance Department regarding GST, the Government shall have to provide additional funds to the tune of Rs 1.75 crore to the Information Department for the year 2018-19 to be reimbursed to the newspapers as GST @ 5%, which will be over and above the Rs 35 crore advertisement GST is essentially a tax only on the value addition at each stage.

India News | Small Shops Need Not Collect 5% GST on GST%. July 2022 marks the fifth anniversary of the Narendra Modi governments landmark indirect tax reform, the Goods and Services Tax (GST), which is based on the premise of One Nation One Tax that makes India a unified, common market.. The GST Council also decided to bring hotel rooms under Rs 1,000 per day under the 12 per cent GST slab, as opposed to tax exemption category at present. U4UVoice - U4U Voice is among the fastest news websites in J&K.

The new GST rate of 5 per cent will also apply on a package containing 10 retail packs of flour of 10 kg each.

The new GST rate of 5 per cent will also apply on a package containing 10 retail packs of flour of 10 kg each.

4902 : Newspapers, Journals And Periodicals, Whether Or Not I Llustrated Or Containing Advertising Material. The advertiser is required to provide their GST No.

If your business ever provides a good or service in exchange for advertising, you should be aware of a recent CRA ruling (RITS 2015-158946), dated November 4, 2015), which sets out how GST/HST applies to barter transactions and includes an example of a person who exchanges advertising services for goods or services. That is good news for advertising agencies.

If the publishing company charges Rs 500,000 for sale of such space then GST payable on the same will be Rs 25,000 (500,000 x 5%). Wood Pulp Products.

Read all the Latest News, Breaking News, watch Top Videos and Live TV here. Ladakh 10 C Mostly Cloudy. No GST on Printed books, including Braille books and newspaper, periodicals & journals, maps, atlas, chart & globe Newspapers, journals and periodicals, whether or not illustrated or containing advertising material. Payment of advertising charges for broadcasting jingles in radio 3. 3.

Newspaper advertising is what the name would suggest and involves running an ad for your business in a publication. HSN Code Chapter 48 for Printing Services. Newspapers, journals and periodicals, whether or not illustrated or containing advertising material ,Products include: Mirchi Powder. Judicial, Non-Judicial stamp papers, Court fee stamps when it is sold by the Government Treasuries or Vendors authorized by the Government.  Kerala Finance Minister K N Balagopal on Wednesday said small unregistered shops or those with an annual turnover of around Rs 1.5 crore are not required to collect 5 per cent GST on essential commodities sold in loose or in small packages of 1 or 2 kg. Now, such suppliers will not have to obtain GST registration, if their turnover is lower than Rs 40 lakh and Rs 20 lakh for goods and services, respectively. in the form of physical goods such as newspapers, magazines, billboards, etc.

Kerala Finance Minister K N Balagopal on Wednesday said small unregistered shops or those with an annual turnover of around Rs 1.5 crore are not required to collect 5 per cent GST on essential commodities sold in loose or in small packages of 1 or 2 kg. Now, such suppliers will not have to obtain GST registration, if their turnover is lower than Rs 40 lakh and Rs 20 lakh for goods and services, respectively. in the form of physical goods such as newspapers, magazines, billboards, etc.

A Kotak Mutual Fund repost describes that reduction in advertising cost will increase the advertising spendings and it will go high by 10% for the year 2017-2018. Newspapers have a better audience in that respect. GST on selling of ad-space in newspapers, dependent on contractual terms, clarifies Finmin Aug 23, 2017 Simply Register/Sign In For advertisement through TV, radio, internet and mobile phone, the

Newspapers to get reimbursement of GST on government advertisements DIPR to be single gateway for making payments.

1,20,000 GST on Commission 18% of Rs. The portal stands among the very few non biased news portals from the  The Government has already revised the advertisement rates of the newspapers in the State announcing considerable hike of more than 50% in the rates notified in 2013. This is the only difference that it will make to the advertising industry as there will more tax levied on.

The Government has already revised the advertisement rates of the newspapers in the State announcing considerable hike of more than 50% in the rates notified in 2013. This is the only difference that it will make to the advertising industry as there will more tax levied on.

Posted: (5 days ago) 1) Select newspaper and ad type (text or classified display) then location.  # A 5 % increase also on dried leguminous vegetables, makhana, wheat or meslin flour, jaggery, puffed rice, organic food. Aerial advertising. If you have AdWords account, you may notice the invoice where GST tax shall be charged from you (Advertiser) for showing ads on bloggers site. 490210. Section 48 of the Competition and Consumer Act 2010 (Cth) outlines this requirement.

# A 5 % increase also on dried leguminous vegetables, makhana, wheat or meslin flour, jaggery, puffed rice, organic food. Aerial advertising. If you have AdWords account, you may notice the invoice where GST tax shall be charged from you (Advertiser) for showing ads on bloggers site. 490210. Section 48 of the Competition and Consumer Act 2010 (Cth) outlines this requirement.

SAC Code applicable for Advertising Services.

Jammu 30 C Clear. Our rough estimate suggests that they could boost headline inflation by up to 0.3 percentage points from August onwards..

The newspaper would have to pay 5 per cent GST on the revenue earned from space selling but can avail of input tax credit for the tax paid by the advertising agency on commission received. GST; INTL TAX; CORP LAWS; Income Tax.

Service tax has been imposed on advertising agencys services from 01.11.1996 vide Notification No.6/96-ST dt. Pulses, cereals like rice, wheat, flour and other such items, weighing below 25 kg or 25 litres, will also attract GST at the same rates.

GST the newspaper advertisement regularly. Payment of advertising charges to ad agencies for publication of tender in newspaper 2. The following SAC (Service Accounting Code) have been established for the various advertising services in India. Government Clarifies On GST On Newspaper Ad Space Sale.

The price must advertise as either $330 or $300 plus $30 (GST) = $330..

TDS on advertising.

Previously, advertising cost and manufacturing expense are considered interchangeably and attract sales tax and VAT. Due to an absence of input tax credit benefits, advertisers were losing huge. But, after GST implementation, spendings on advertising is considered available for input tax credit on online advertising for paying 18% GST. Latest News | Latest Business News | BSE | IPO News. India News | GST Complicated, Uniform Tax System Not Right for India: Kejriwal at Traders' Meet in Gujarat.

The GST Council has decided to ease the process for intra-state supplies made through e-commerce portals.

Recruitment newspaper ads have to be attractive, specific, clear and precise. This will come into effect from January 1, 2023. Chapter 49: Printed Books, Newspapers, Pictures And Other Products Of The Printing Industry; Manuscripts, Typescripts And Plans.

The Government has also increased the advertisement budget of the newspapers substantially during the past three years from Rs 22 crore in 2014-15 to Rs 35 crore for 2018-19. Public Notice Advertisement in Newspaper in Mumbai Or Public Notice Ad in News Paper in Mumbai. GST is applicable to all modes of advertising including the sale of space in print media While this leads to an increase in cash outflow, the free flow of credits on the procurement side leads to an overall reduction in the value of advertising. GST commissioner, Sansar Chand, a 1986-batch Indian Revenue Service officer, his two superintendents of the department and one personal staff were nabbed by the CBI along with five others in a late-night operation [] Previously, this was exempt from Goods ad Service Tax (GST).

All Sections. When it comes to national newspapers, the price starts at $1000 for a full-page ad.

Get latest articles and stories on India at LatestLY. 2.

Ad agencies that operate in multiple states may face trouble, because of the introduction of Central GST and State GST. However, Services provided by advertisement agencies relating to making or preparation of advertisements would be covered in this entry and would thus be taxable. 0%.

Advertisement in pamphlets etc., e-Assessment; BM Cases Story Highlights: kn balagopal about gst hike. Stay Tuned for Latest Updates!

They can take full input tax credit of inward supplies.

Chapter 49: Printed Books, Newspapers, Pictures And Other Products Of The Printing Industry; Manuscripts, Typescripts And Plans. Advertising Spend

TDS on advertising. Hence where only space for advertisement and print media is supplied (SAC 998362) the rate of tax applicable is 2.5% under CGST & SGST respectively and where they are supplying ornate space it shall be treated as other advertisement space falling under item (ii) of serial no. Draft your Public Notice for documents loss with Yourdoorstep Executive and Cross to check the same or mark a draft to us on [emailprotected] Choose publishing date. The ITC restrictions are there from Section 17 (5) if expense is not specifically covered under section 17 (5) and such expense is used for business or furtherance of business, ITC would be eligible. PTI @ PTI_News.

9906088332. Bangladesh requests loan from IMF; economists say 'reforms in financial sector' needed. GST on advertisement in print media: In this case, the advertisement is published in print media like newspapers, magazines, etc. Wood Pulp Products. agency also charged gst on net value if newspaper charge 85 net+gst 5% on 100 gross and agency charge 100 +gst VJ Hebbar (Asst.

Manager) (529 Points) Replied 25 July 2017 Mr.Vishal as agency will be paying the 5% GST on 85% of the value on behalf of his client and will be entitled to collect and pay the 15% of the value from client.

Therefore, AdWords is required to collect tax at source (from Advertisers) and shall be paid to the Government by AdWords (e-commerce operator). COVID-19 Live Report. can also adopt the GST treatment if they make an onward supply of media sales, such as a holding company buying and supplying it to its related companies. Delhi Chief Minister Arvind Kejriwal on Tuesday opposed the Goods and Services Tax (GST) and said the system of uniform tax is not right for a country like India and he is personally not in favour of it. A list of goods and services that will get expensive from today: # A 5% increase on packed foods like milk, curd and paneer; unpacked ones including rice and wheat when packed. Print media such as Newspapers, magazines need to charge tax at 5% on advertisement fee collected by them.  In a significant decision aimed at extending substantial financial benefit to the print and the electronic media in the State, the Finance Department today ordered that GST chargeable on advertisement bills shall be paid by the government.

In a significant decision aimed at extending substantial financial benefit to the print and the electronic media in the State, the Finance Department today ordered that GST chargeable on advertisement bills shall be paid by the government.

On the other hand, if the advertisement agency sells space for advertisement as an agent of the newspaper on commission basis, it would be liable to pay GST at the rate of 18% on the sale commission it receives from the newspaper, the statement added. ITC of GST paid on such sale commission would be available to newspaper. JAMMU: In a significant decision aimed at extending substantial financial benefit to the print and the electronic media in the State, the Finance Department today ordered that GST ADS1114IDGST Price,ADS1114IDGST stock,ADS1114IDGST Datasheet,Sell a large stock of TI ADS1114IDGST Online at Our Ventronchip.com.We are an Online Competitive Distributor in the Electronic components Area. News print in rolls or sheets. 3.2 Media sales refer to: (i) Sale of advertising space for hardcopy print and outdoor advertisements via newspapers, magazines, billboards, etc. Hence, you need a catchy job title that will hook the readers to your advertisement. Such advertising in print media attracts a GST of five percent.  Please provide the TDS rates on following activities and give reason also 1. 15.3k members in the AutoNewspaper community.

Please provide the TDS rates on following activities and give reason also 1. 15.3k members in the AutoNewspaper community.

2) Select package, compose ad and check the preview.  a. GST on advertising through digital media In these transactions, there are two parties involved the advertiser and the publisher.

a. GST on advertising through digital media In these transactions, there are two parties involved the advertiser and the publisher.  This e-tax Guide supersedes the Nov 2004 edition. 4902 : Newspapers, Journals And Periodicals, Whether Or Not I Llustrated Or Containing Advertising Material.

This e-tax Guide supersedes the Nov 2004 edition. 4902 : Newspapers, Journals And Periodicals, Whether Or Not I Llustrated Or Containing Advertising Material.  It is a single, destination-based, multi-stage tax on the supply of goods and services, right from the manufacturing to the However, most of the Indian companies are likely to plow in extra profits, which according to one report will boost overall ad spends by around 10 percent, or over Rs 5,000 crore. 4902 : Newspapers, Journals And Periodicals, Whether Or Not I Llustrated Or Containing Advertising Material.

It is a single, destination-based, multi-stage tax on the supply of goods and services, right from the manufacturing to the However, most of the Indian companies are likely to plow in extra profits, which according to one report will boost overall ad spends by around 10 percent, or over Rs 5,000 crore. 4902 : Newspapers, Journals And Periodicals, Whether Or Not I Llustrated Or Containing Advertising Material.

About the Author.

About the Author.

This will reduce the import bill and increase exports in the long run.

; The alcohol and tobacco industries will have to pay more taxes for advertising in the GST-regime. Clarifying on the issue of applicability of Goods and Services Tax (GST) on advertisement in print media, the finance ministry on Wednesday said that a 5 per cent GST would be levied if an advertisement agency buys space from the newspaper and sells such space for advertisement to clients on its own account. TDS, ST, ROC, CMA Online, GST, Tally, XL, ERP for CA firm at Malviya Nagar, ND-17. A unified GST chargeable through the supply chain should significantly mitigate the cascading impact of tax and thereby reduce the cost of creating an ad. Twentyfournews.com, a news portal from the house of Insight Media City. Advertising Advertising Your supply of advertising service attracts GST unless it qualifies for zero-rating as an international service under section 21 (3) of the GST Act. Newspapers, journals and periodicals, whether or not illustrated or containing advertising material, appearing at least four times a week. Advertisement in Newspapers . The applicant will need to submit his PAN, mobile number, and email address in Part A of Form GST REG-01 on the GSTN portal or through the Facilitation center (notified by the board or commissioner). Advertising agency means any person engaged in providing any service connected with the making, preparation, display or exhibition of advertisement and includes an advertising consultant. The newspaper would have to pay 5 per cent GST on the revenue earned from space selling but can avail of input tax credit for the tax paid by the advertisement agency on commission received. Payment of advertising charges for broadcasting jingles in radio 3. Wood Pulp Products.

Please provide the TDS rates on following activities and give reason also 1.

April 7, 2018. jksachnews. to Google, to claim the Input Tax Credit in respect of payment made to Google. 7.  Media Plan. Select newspaper and ad type (English, Hindi, text, or classified display) then chose the state.

Media Plan. Select newspaper and ad type (English, Hindi, text, or classified display) then chose the state.

On the 5 per cent GST, Balagopal had earlier, in the State Assembly, said the branded companies have to pay a tax of 5 per cent on packaged products, ..

GST ON ADVERTISEMENT.

GST ON ADVERTISEMENT.

Posted on August 4, 2017 Author Samir Post navigation. 21 and accordingly will attract tax @9% under CGST & SGST respectively.

Nilkesh Parmar (98 Points) Replied 21 August 2020.

Here is a list of items and services that will attract GST. Example 2: For another example, on November 20, we make a $3,000 payment to an advertising agency in order to advertise one of our products in a local magazine.

SAC (Services Accounting Code) are used for the identification of the service.

Example Business advertising a product on their e-commerce site.

For instance, ABC Private Limited is a leading newspaper publishing company.

Advertising Cost. Payment of advertising charges to ad agency for display of digital on pillars 4.

The Council has broadly approved the GST rates for goods at nil rate, 5%, 12%, 18% and 28% to be levied on certain goods. Therefore, it is illegal to advertise prices without including GST.

UP collected Rs 700 cr. Explaining the GST, she said that when GST was rolled out, a GST rate of 5 per cent was made applicable on branded cereals, pulses, flour. Goods that are attract CGST & SGST/UTGST @ 2.5% or Nil / IGST @ 5% or NIL. 5% GST rate on Selling of Space for Advertisement in Print Media; 18% GST rate on other advertising agencies.

Advertisement.

Message us #U4UVOICE to Join.

Payment of advertising charges to ad agencies for publication of tender in newspaper 2. GST on Print Media Ad 5% of Rs.

On the 5 per cent GST, Balagopal had earlier, in the State Assembly, said the branded companies have to pay a tax of 5 per cent on packaged products, .. Book job advertisement in newspaper - Release Advt.

July 2022 marks the fifth anniversary of the Narendra Modi governments landmark indirect tax reform, the Goods and Services Tax (GST), which is based on the premise of One Nation One Tax that makes India a unified, common market.. Search for: Search. GST is applicable to all modes of advertising including the sale of space in print media While this leads to an increase in cash outflow, the free flow of credits on the procurement side leads to an overall reduction in the value of advertising. a.

This may get complex in the coming months.