the illustration is based on being opted out of the workplace pension; if you meet the qualifying criteria, you will be auto-enrolled after 90 days and will have the option to opt out after this. Company Reg No. What is their service like? Have they won awards? To get in touch, email: info@uktaxcalculators.co.uk. They will also assist you with various tax, loans and mortgage calculations. Signing up to be a Parasol employee could not be simpler. ICS Accounting has a range of contractor accounting services that meet your requirements based on the sector you operate in and the rate you charge. Why do I have to pay Employers National Insurance?

JotForm.prepareCalculationsOnTheFly([null,{"name":"fullName","qid":"1","text":"FULL NAME","type":"control_textbox"},{"name":"preferredTime","qid":"2","text":"PREFERRED TIME","type":"control_textbox"},{"name":"emailAddress","qid":"3","text":"EMAIL ADDRESS","type":"control_textbox"},null,null,null,{"name":"name7","qid":"7","text":"Send Form","type":"control_button"},null,{"name":"typeA9","qid":"9","text":"Get Page URL","type":"control_widget"},{"description":"","name":"phoneNumber","qid":"10","subLabel":"","text":"PHONE NUMBER","type":"control_textbox"}]); A comprehensive range of essential online financial, salary and tax calculators How Long Can I Work for the Same Company as a Contractor?

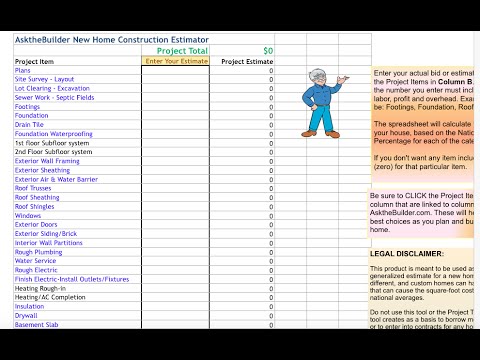

Select how frequently your Umbrella Company pays you - (Monthly, 4-Weekly, 2-Weekly, Weekly). The information I provide is best to my knowledge for UK financial year 2020/21. For Outside IR35 you can pay yourself dividends, so typically you pay yourself a salary of 8,750 (for 20/21) or slightly higher, which mean you qualify for state pension years and after calculating profit (revenue expenses incl. You input your umbrella company payslip frequency, i.e Weekly, Monthly and the calculator starts generating your payslips and a summary of the total income over the contract period. They keep coming back as we offer: });

One of the main questions on contractors minds is How much money will I take home?. We understand that you need to know what youll actually be left with after you have been paid and taken care of any deductions such as tax. Thats why over 5000 contractors trust Nixon Williams as their accounting partner. Being inside IR35 means you need to make provisions for paying Employers National Insurance on any income earned - but this figure can have allowable expenses and umbrella fees deducted before being calculated. Jubilee House, East Beach, Lytham St. Annes, FY8 5FT, Work 52 weeks per full tax year (4.3 weeks per month), Tax code 1257L (The assumption of this calculation is that you will earn under 100k per year.

Thats why over 5000 contractors trust Nixon Williams as their accounting partner. Being inside IR35 means you need to make provisions for paying Employers National Insurance on any income earned - but this figure can have allowable expenses and umbrella fees deducted before being calculated. Jubilee House, East Beach, Lytham St. Annes, FY8 5FT, Work 52 weeks per full tax year (4.3 weeks per month), Tax code 1257L (The assumption of this calculation is that you will earn under 100k per year.

Do I need Professional Indemnity Insurance if I use an Umbrella Company? Limited calculation based on outside IR35. So what are you waiting for? If you have been offered a higher take home pay, take a moment to think how this can be possible? Soak up some of the best expertise in the industry with our free resources. FY4 5FS, Call our best advice team As contractor accountants, Brookson are dedicated to helping our clients maximise their earning potential. if your hirer has no supervision, direction or control over you, you can also claim home to site travel expenses subject to completing a questionnaire that validates this. For every 1,000 contributed, it costs 520 or 420 for a basic rate and higher rate tax payer, respectively. It provides a jargon free overview of the Brookson Umbrella service, along with the key benefits. Sponsored by Intouch Accounting, ContractorUKs Calculator Partner. Our take home calculator can give you complete confidence when managing your finances by outlining your take-home pay on any given project and contract.  And, after all these years, we know all legislative and compliance regulations inside out. There are a variety of benefits to joining an umbrella company. Umbrella Companies were set up to provide a pay solution for people who know they are working within IR35, i.e they will be classed as employees under the legislation and thus should be paying employer related contributions as they would have to if permanently employed with salary. The Umbrella receives payment from the agency, deduces the 'salary' for the contractor, pays the relevant NI and PAYE taxes and forwards payment to the contractor. The only thing its not going to do is calculate corporation tax, however the impact is very low between 0% and 1%. The types of expenses you can claim tax-free can change based upon different assignments, please see our business costs and expense guide for more information. A new contract would starting the following Monday and the cycle would repeat. Off Payroll for Public Sector Contractors, The benefits of working with Umbrella Companies, Umbrella company expenses and dispensations. Simply complete the call back form and well be in touch to provide you with a personalised calculation based on your circumstances. If you have a contract rate of 1,500 per week but can legitimately provide proof of 500 of allowable expenses in the week, the Umbrella will only forward a salary to you of 1,000 upon which tax, national insurance and employers national insurance will be calculated. From time to time we would like to contact you with news and updates about our services.

And, after all these years, we know all legislative and compliance regulations inside out. There are a variety of benefits to joining an umbrella company. Umbrella Companies were set up to provide a pay solution for people who know they are working within IR35, i.e they will be classed as employees under the legislation and thus should be paying employer related contributions as they would have to if permanently employed with salary. The Umbrella receives payment from the agency, deduces the 'salary' for the contractor, pays the relevant NI and PAYE taxes and forwards payment to the contractor. The only thing its not going to do is calculate corporation tax, however the impact is very low between 0% and 1%. The types of expenses you can claim tax-free can change based upon different assignments, please see our business costs and expense guide for more information. A new contract would starting the following Monday and the cycle would repeat. Off Payroll for Public Sector Contractors, The benefits of working with Umbrella Companies, Umbrella company expenses and dispensations. Simply complete the call back form and well be in touch to provide you with a personalised calculation based on your circumstances. If you have a contract rate of 1,500 per week but can legitimately provide proof of 500 of allowable expenses in the week, the Umbrella will only forward a salary to you of 1,000 upon which tax, national insurance and employers national insurance will be calculated. From time to time we would like to contact you with news and updates about our services.

Do you receiveyour own contact who you can call and email? With hundreds of expert head office staff, we are passionate about excellent support and dedicated to ensuring you always get paid on time and in full. No need to register, just enter your comment and click add! A recruiter told me about you In our calculator we also include Bench Time which is the amount of time you spend not being paid, which is typically time between contractors. 2 Mannin Way However, all calculations provided are estimates based upon information you provide. Our take home pay calculator provide a more realistic picture of what you could expect to earn as a contractor as compared to many other online calculators that would show much higher take home pay values but cant offer the same in reality. Being a Parasol employee is also an ideal solution if you are working shorter contracts or are in between permanent work. Dave is still actively involved in its management, supported by a dedicated team of contractors and freelancers. Click Here to start referring! you will pay corporation tax on 5% allowable expenses. Pre IR35, it was possible for an individual to have a contract that would start on Monday and end on Friday. As a result of this comprehensive resource for those new to contracting and experienced old-hands, we're proud to call ourselves The Expert Guide to Contracting, and have even published the definitive guide to contracting - The Contractors' Handbook: the expert guide for UK contractors and freelancers.

Our monthly audience of regular readers is made up of contractors, freelancers, interims and consultants from the IT, telecoms, engineering, oil, gas and energy, business, marketing and medical sectors.

Our monthly audience of regular readers is made up of contractors, freelancers, interims and consultants from the IT, telecoms, engineering, oil, gas and energy, business, marketing and medical sectors.

Working as an umbrella employee also means that IR35 will not be relevant to you which is a great relief for many contractors.  If you need an accountant or are thinking of switching accountants please complete the enquiry form below. When it comes to looking at which is best between the two, thats entirely dependent Why use an umbrella company? This is important as tax is calculated cumulatively.

If you need an accountant or are thinking of switching accountants please complete the enquiry form below. When it comes to looking at which is best between the two, thats entirely dependent Why use an umbrella company? This is important as tax is calculated cumulatively.

WORKING THROUGH OUR EMPLOYMENT UMBRELLA SUBJECT TO SDC, WORKING THROUGH YOUR OWN LIMITED COMPANY, Add your details below to subscribe to our blog. Your enquiry will be sent to ContractorUKs Calculator Partner Intouch Accounting who will contact you to discuss your accounting needs. The ICS contractor tax calculator has been designed specifically with contractors in mind. Company Registration Number 3120233. Contractor AccountingSME AccountingRecruiter PSLsOutsourced PayrollICS Umbrella, Callback Day Lets get started. Rate used 15.5% (Limited Cost Trader) including the first year discount, Director annual salary of 8,788 (unless IR35 applies to an assignment), Personal tax calculated on the assumption that all available profit is extracted and income is consistent throughout the year. One of the bigger factors for take home pay are expenses, as for some contractors travel / accommodation costs can be significant. A comprehensive range of essential online financial, salary and tax calculators Its worth future proofing yourself and using an umbrella company that gives you the flexibility to work this way. Access to leading contractor services. Example expenses include travel, food and drink (although possible only if working away and even then may be disallowed), accommodation, professional subscriptions and specialist equipment required for work. limitedcompanytake home pay calculator click here, Employee National Insurance (Higher Rate). Once signed, you are fully employed by Parasol and ready to be paid. We also offer limited company services through our dedicated contractor accountants- Dolan Accountancy. It can skip bank holidays and weekends, or limit itself to a certain number of work days per week. Help - find relevant tax tools and calculators - go back to top.  With Brookson by your side, you can rest assured that youre paying yourself in the fairest, most tax efficient way possible, meaning that you only pay HMRC exactly what you owe and not a penny more. }, 20); Select whether you would like to have your student loan deducted from your Umbrella payslip. /*INIT-END*/ Using our contractor income calculator could not be easier.

With Brookson by your side, you can rest assured that youre paying yourself in the fairest, most tax efficient way possible, meaning that you only pay HMRC exactly what you owe and not a penny more. }, 20); Select whether you would like to have your student loan deducted from your Umbrella payslip. /*INIT-END*/ Using our contractor income calculator could not be easier.  At ICS Accounting we specialise in offering contractor services, such as a wide range of accountancy, administrative and tax advisory services to ensure you and your limited company are operating in a compliant manner. Working with an umbrella company is a great way to test the contracting life without the financial demands of running your own limited company. Read the full details of our privacy policy. Whether youre looking for a net take-home pay calculator in the UK or something more specific, like a full salary and dividend calculator for a certain financial year, youve come to the right place. By using this site, you agree we can set and use cookies. A high quality news service from a professional editorial team Whilst not the be all or end all, it does show that they care about service and their reputation. Please review our privacy policy to see how we use your data. Pharmaceutical and Healthcare Contractors, Guide to finding Contract or Freelance Work. setTimeout(function() {

At ICS Accounting we specialise in offering contractor services, such as a wide range of accountancy, administrative and tax advisory services to ensure you and your limited company are operating in a compliant manner. Working with an umbrella company is a great way to test the contracting life without the financial demands of running your own limited company. Read the full details of our privacy policy. Whether youre looking for a net take-home pay calculator in the UK or something more specific, like a full salary and dividend calculator for a certain financial year, youve come to the right place. By using this site, you agree we can set and use cookies. A high quality news service from a professional editorial team Whilst not the be all or end all, it does show that they care about service and their reputation. Please review our privacy policy to see how we use your data. Pharmaceutical and Healthcare Contractors, Guide to finding Contract or Freelance Work. setTimeout(function() {

To get a more accurate comparison please use our IR35 contractor calculator. For instance, in most cases, if someone gets 75,000 a year that amounts includes 13.8% so actual salary is 65,905 + 9.095 Employers NI. setTimeout(function() { document.getElementById("si" + "mple" + "_spc").value = "81083723898367-81083723898367"; Head Office: And you can find out more about the April 2021 IR35 legislationchanges here: Contractor Umbrella IR35 Advice Hub. Enter the tax codes used for you for each corresponding tax year.

To get a more accurate comparison please use our IR35 contractor calculator. For instance, in most cases, if someone gets 75,000 a year that amounts includes 13.8% so actual salary is 65,905 + 9.095 Employers NI. setTimeout(function() { document.getElementById("si" + "mple" + "_spc").value = "81083723898367-81083723898367"; Head Office: And you can find out more about the April 2021 IR35 legislationchanges here: Contractor Umbrella IR35 Advice Hub. Enter the tax codes used for you for each corresponding tax year.  Preparation and online submission of the companys annual return. What features would you like to see on UKTaxCalculators.co.uk? 01253 362 062. Thats where Brookson comes in. THESE CALCULATIONS ARE BASED ON THE FOLLOWING ASSUMPTIONS.

Preparation and online submission of the companys annual return. What features would you like to see on UKTaxCalculators.co.uk? 01253 362 062. Thats where Brookson comes in. THESE CALCULATIONS ARE BASED ON THE FOLLOWING ASSUMPTIONS.  Contractor Umbrella offers all of the aspects that are important to contractors like you, in fact weve been supporting contractors for nearly 20 years so you can be sure you are in safe, experienced hands. These calculations are based on the assumption that you work 48 weeks per full tax year. It really couldnt be any more simple, and its completely free! When you submit an expenses claim with Parasol, we may be able to deduct them from our invoice (the money we receive from the agency) before tax and reimburse them back to you enhancing your income. By entering just a few basic details into the tax calculator above, you can quickly and effectively see how much you could be earning by working as a contractor through ICS Umbrella, our umbrella company or as your own limited company using ICS Accounting. Phone Number

The calculations are for illustration purposes only and are based on a series of assumptions. We understand you might have lots of questions, so why not give one of our friendly experts a call on 01206 591 000. Keeping track of your finances can be difficult as a freelancer or contractor. This calculator takes those factors into consideration to provide you with an estimate of your annual income and expenses, categorising this into weekly take-home pay with an ICS Accounting limited and umbrella company. I found you on Google/Bing/Yahoo

Contractor Umbrella offers all of the aspects that are important to contractors like you, in fact weve been supporting contractors for nearly 20 years so you can be sure you are in safe, experienced hands. These calculations are based on the assumption that you work 48 weeks per full tax year. It really couldnt be any more simple, and its completely free! When you submit an expenses claim with Parasol, we may be able to deduct them from our invoice (the money we receive from the agency) before tax and reimburse them back to you enhancing your income. By entering just a few basic details into the tax calculator above, you can quickly and effectively see how much you could be earning by working as a contractor through ICS Umbrella, our umbrella company or as your own limited company using ICS Accounting. Phone Number

The calculations are for illustration purposes only and are based on a series of assumptions. We understand you might have lots of questions, so why not give one of our friendly experts a call on 01206 591 000. Keeping track of your finances can be difficult as a freelancer or contractor. This calculator takes those factors into consideration to provide you with an estimate of your annual income and expenses, categorising this into weekly take-home pay with an ICS Accounting limited and umbrella company. I found you on Google/Bing/Yahoo

A high quality news service from a professional editorial team You will find the default values are the standard under 65's tax codes for the tax years supported. Whitehills Business Park, Blackpool Preparation and online submission of payroll for the directors salary (if required). UK IR35 contractor comparison and calculator. This will reduce your net income by 2.24 and 1.91 for a basic and higher rate taxpayer respectively. By doing this the individual would be paid directly into company set up to take the contractual payments, and the would be employer would not have to pay any employer related national insurance contributions. You can increase pension contributions by making additional, voluntary contributions to your pension scheme. Did you know that you can refer a friend to ICS Accounting? I'm a current client

Taking into account factors such as contracted rate, tax compliance, payment cycle, pension deductions and weekly work hours, our contractor salary calculator for UK workers is a reliable gauge of what will end up in your pocket. }, 20); Of course you do! Online maintenance of the company books and records. In 1999, the then Chancellor, Gordon Brown announced new legislation called IR35, which would attempt to kerb the tax avoidance possible by using 'Personal Service Companies'. The website and its content is copyright of Contractor Umbrella 2018. Company DetailsRead More, View Email Formats for Contractor Calculator, Contractor Calculators headquarters are in 112C Roman Rd, Basingstoke, Hampshire, RG23 8HE, United Kingdom, Contractor Calculators phone number is +44 871 218 5152, Contractor Calculators official website is www.contractorcalculator.co.uk, Contractor Calculators revenue is <$5 Million, Contractor Calculator is in the industry of: Accounting Services, Business Services, Contractor Calculator's main competitors are: Contractor UK, Shout99, Mondaq, Nation1099, The technologies that are used by Contractor Calculator are: DoubleClick, Google Ads, Join the world's top companies using Zoominfo, See more information about Contractor Calculator, r monthly audience of regular readers is made up of contractors, freelancers, interims and consultants from the IT, telecoms, engineering, oil, gas and energy, business, marketing and medical sectors. For Inside IR35 there is 5% allowable expenses which applies only if 1) you work for private sector 2) You operate using PSC/LTD company (not Umbrella), and apparently if you dont have any expenses (accounting, payroll etc.) $('input_1').hint('FULL NAME');  to work either limited Choose whether your student loan scheme is pre 1 Sep 2012, or post 1 Sep 2012. The calculations are based upon the following criteria: Do you know your tax liabilities at any given time? Every sign up will be entered into a draw to WIN 100 Amazon Vouchers. You can tick the box to include weekends and bank holidays in the contract days calculation - we will automatically find and either skip or include these days in your chargeable work period.

to work either limited Choose whether your student loan scheme is pre 1 Sep 2012, or post 1 Sep 2012. The calculations are based upon the following criteria: Do you know your tax liabilities at any given time? Every sign up will be entered into a draw to WIN 100 Amazon Vouchers. You can tick the box to include weekends and bank holidays in the contract days calculation - we will automatically find and either skip or include these days in your chargeable work period.  Use the 'Calculate your take-home pay' tool below and discover the best option for you.

Use the 'Calculate your take-home pay' tool below and discover the best option for you.  Using a contractor calculator to determine your take-home pay can be a quick and convenient solution to work out what you can expect to be earning. Ad hoc advice, when you need it, provided by our SME manager. Remember, we do our best to make sure our systems are up to date and error free.

You will have lots of questions, so it is importantyou feel comfortable with them.As you can see, its not all about their take home pay calculation. The assignment income is too low to process, please enter a higher assignment rate. setTimeout(function() { Find out what you could be taking home through Contractor Umbrella today! Yes, I'd like you to email me

MondayTuesdayWednesdayThursdayFriday, How did you hear about ICS? All you now need to do is enter the start and end date of your contract - even if this spans across 2 or more tax years we will be able to accurately calculate your payslips. Year end financial statements and corporation tax return. $('input_3').hint('EMAIL ADDRESS'); Expert commentary and analysis from industry and sector leaders

takes into account a personal allowance based on a 1257L tax code, taxes at basic rate, higher rate, additional rate.

Using a contractor calculator to determine your take-home pay can be a quick and convenient solution to work out what you can expect to be earning. Ad hoc advice, when you need it, provided by our SME manager. Remember, we do our best to make sure our systems are up to date and error free.

You will have lots of questions, so it is importantyou feel comfortable with them.As you can see, its not all about their take home pay calculation. The assignment income is too low to process, please enter a higher assignment rate. setTimeout(function() { Find out what you could be taking home through Contractor Umbrella today! Yes, I'd like you to email me

MondayTuesdayWednesdayThursdayFriday, How did you hear about ICS? All you now need to do is enter the start and end date of your contract - even if this spans across 2 or more tax years we will be able to accurately calculate your payslips. Year end financial statements and corporation tax return. $('input_3').hint('EMAIL ADDRESS'); Expert commentary and analysis from industry and sector leaders

takes into account a personal allowance based on a 1257L tax code, taxes at basic rate, higher rate, additional rate.