AI can help automate labor intensive processes, leading to lower costs and saved time.  The result is an improved customer service experience and increased profitability. The technology will not only improve the customer experience but also aid insurance Artificial Intelligence in the Insurance Industry. Insurance Technology allows your business to be organized, flexible, and cost effective. You can save money, time, and labor by: Implementing more efficient processes and technology to streamline your operations and increase productivity. Reduce claims associated with: Preventing injuries and There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. In the future, your clients may have the option to convert these smart contracts into actual life insurance policies. Insurance companies are facing rapid tectonic shifts in their business operations as the financial environment changes and new technological advancements are made in the insurance industry. Under the agreement, Carahsoft will serve Several insurance firms are utilizing artificial intelligence (AI) to gain a competitive advantage in today's digital world. Amongst all the industries that are witnessing a boom after conjugating with Artificial Intelligence, the insurance industry has been the oldest and perhaps the slowest to embrace technological upgrade. The Insurance industry can benefit from smart contracts along with the advancements in Artificial intelligence and machine learning technology.

The result is an improved customer service experience and increased profitability. The technology will not only improve the customer experience but also aid insurance Artificial Intelligence in the Insurance Industry. Insurance Technology allows your business to be organized, flexible, and cost effective. You can save money, time, and labor by: Implementing more efficient processes and technology to streamline your operations and increase productivity. Reduce claims associated with: Preventing injuries and There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. In the future, your clients may have the option to convert these smart contracts into actual life insurance policies. Insurance companies are facing rapid tectonic shifts in their business operations as the financial environment changes and new technological advancements are made in the insurance industry. Under the agreement, Carahsoft will serve Several insurance firms are utilizing artificial intelligence (AI) to gain a competitive advantage in today's digital world. Amongst all the industries that are witnessing a boom after conjugating with Artificial Intelligence, the insurance industry has been the oldest and perhaps the slowest to embrace technological upgrade. The Insurance industry can benefit from smart contracts along with the advancements in Artificial intelligence and machine learning technology.

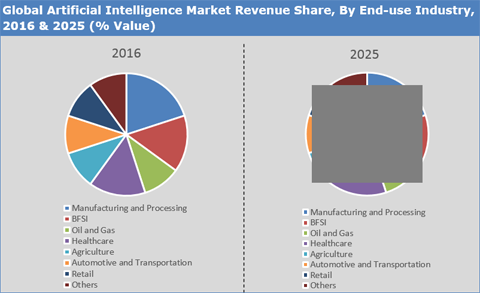

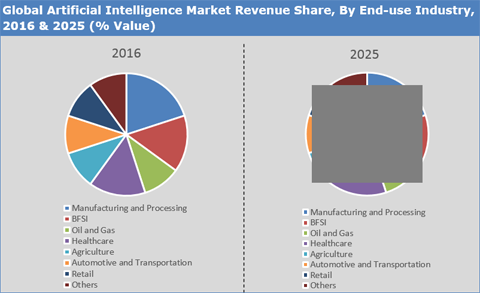

Artificial intelligence is likely to affect the entire landscape of insurance as we know it. AI is turning the insurance industry around. A key reason for this is the presence of a strict regulatory environment has presented significant challenges for insurers to adopt Artificial intelligence in the insurance industry. Adopting artificial intelligence in the routine activities of the insurance industry would bring four benefits: 1. Insurance companies have been utilizing smart contracts for quite some time now. As an industry, insurance has the reputation of being conservative which makes sense, given that the point of insurance is to defend against risk. Get the latest Pittsburgh local news, breaking news, sports, entertainment, weather and traffic, as well as national and international news, from the Pulitzer Prize-winning staff of the Pittsburgh Post-Gazette. These principles were established to inform Examples include gathering information, analyzing data by running a model, and making decisions. And, in a bid to cover the possibilities and challenges of inculcating artificial intelligence and machine learning in the insurance industry, we have already learned a lot in this four-part series. Strict regulation, outdated business practices, and other factors have made insurance companies slow to adopt marketing automation and other Insurtech. This failure to embrace technology leaves customers under-served and agencies Why the insurance industry needs AI solutions; What insurers are already doing in this area, and; How AI will impact the industry in the foreseeable future. 2Q2019 saw a record of $7.4B invested in AI startups, with the majority going to autonomous vehicles and healthcare-related companies. Since 2013, $66B has been invested in AI start-ups across nearly 7,000 deals, with several $100M+ mega deals in the most recent quarters.3 Chinas 2030 Planaims to build a $150B AI industry in China alone. To better understand insurance carriers perceptions and the potential benefits and challenges impacting AI and ML adoption, LexisNexis Risk Solutions surveyed more than 300 insurance professionals across the top 100 U.S. carriers within the auto, home, life and commercial markets. InsurTech companies are leveraging Artificial Intelligence (AI) to conquer more ground in todays digital world. The use of AI has increased exponentially across all industries over the past several years. Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry. Today, t he insurance market is dominated by massive national brands and legacy product lines that havent substantially evolved in decades. The advancements in Artificial Intelligence are bringing a seismic, tech-driven shift.

Here are some of them: Pricing Insurance is an industry that relies on data, and embracing technology enhances its capability to gain better knowledge about its consumers, helping them predict and offer better insurance policies. Hence, the concept of Artificial Intelligence in the Insurance industry analyzing data, anticipating results and helping with decision making is not so far fetched after all. Insurance is a $1.2 trillion industry in the U.S. alone, employing 2.9 million people. At its simplest, Artificial Intelligence (AI) is a set of computerized tools designed to achieve objectives that usually require human intelligence. Likewise, it could have a big impact on the insurance industry. Intangible assets and risks, artificial intelligence and the sharing economy: @PC_360 looks into the factors prompting accelerated innovation in the #InsuranceIndustryand what's involved in implementing it. New Jersey, NJ -- -- 07/19/2022-- The Global Artificial Intelligence (AI) in Insurance Market Report assesses developments relevant to the

Here are some of them: Pricing Insurance is an industry that relies on data, and embracing technology enhances its capability to gain better knowledge about its consumers, helping them predict and offer better insurance policies. Hence, the concept of Artificial Intelligence in the Insurance industry analyzing data, anticipating results and helping with decision making is not so far fetched after all. Insurance is a $1.2 trillion industry in the U.S. alone, employing 2.9 million people. At its simplest, Artificial Intelligence (AI) is a set of computerized tools designed to achieve objectives that usually require human intelligence. Likewise, it could have a big impact on the insurance industry. Intangible assets and risks, artificial intelligence and the sharing economy: @PC_360 looks into the factors prompting accelerated innovation in the #InsuranceIndustryand what's involved in implementing it. New Jersey, NJ -- -- 07/19/2022-- The Global Artificial Intelligence (AI) in Insurance Market Report assesses developments relevant to the  The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Blockchain-based networks can secure customer data and automate payments. This has allowed them to deploy data modeling, predictive analysis, and machine learning across the

The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Blockchain-based networks can secure customer data and automate payments. This has allowed them to deploy data modeling, predictive analysis, and machine learning across the  Given the tentative stability and natural catastrophes, insurance companies often stand on a trembling ground and confront massive challenges, even when it comes to adopting seamless and intuitive digital solutions such as Artificial Intelligence in But other areas that arent always top of mind, like insurance, have also begun to use artificial intelligence. As per a recent report, the artificial intelligence (AI) in insurance market size is valued at USD 6.92 billion by 2028 and is expected to grow at a compound annual growth rate of 24.05% in the forecast period of 2021 to 2028 ( source ). Historically, the insurance industry hasnt felt the effects of digital disruption, due to a strict regulatory environment, the scale required to create a risk portfolio, and the time needed to establish trust with customers. New York, United States, July 25, 2022 (GLOBE NEWSWIRE) -- Specialty insurance offers coverages for more risky accounts and odd, challenging, and unique insurance needs. Artificial intelligence (AI) and machine learning (ML). Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry.

Given the tentative stability and natural catastrophes, insurance companies often stand on a trembling ground and confront massive challenges, even when it comes to adopting seamless and intuitive digital solutions such as Artificial Intelligence in But other areas that arent always top of mind, like insurance, have also begun to use artificial intelligence. As per a recent report, the artificial intelligence (AI) in insurance market size is valued at USD 6.92 billion by 2028 and is expected to grow at a compound annual growth rate of 24.05% in the forecast period of 2021 to 2028 ( source ). Historically, the insurance industry hasnt felt the effects of digital disruption, due to a strict regulatory environment, the scale required to create a risk portfolio, and the time needed to establish trust with customers. New York, United States, July 25, 2022 (GLOBE NEWSWIRE) -- Specialty insurance offers coverages for more risky accounts and odd, challenging, and unique insurance needs. Artificial intelligence (AI) and machine learning (ML). Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry.  But the technology faces big challenges, especially with regard to customer privacy.

But the technology faces big challenges, especially with regard to customer privacy.  However The AI insurance use cases described in this post hold strong potential for improving operational efficiency, containing costs, and enabling insurance companies to pivot to digital-first customer experience and technology-enhanced Whereas, AI can analyze potential risks and help develop customer-specific marketing tactics. These task involve G athering information; Analyzing data by running models for example of projected sales. Artificial Intelligence in Insurance Market Share, Size, Global Industry Key Tactics, Historical Analysis, Growth, Segmentation, Application, Technology, Trends and Opportunities Forecasts to 2029 But with each passing year, the level of sophistication of AI-based Sounds hard to believe! Its time for insurers to rethink their business models and incorporate AI. Business Insurance. New specially tailored products will attract more customers at lower prices. Barring any fantastic scenarios, AI will likely remain a partner for insurance agents rather than their replacement. This can be done when artificial intelligence scans volumes of 2018 literature. While the concept might still seem somewhat futuristic, artificial intelligence (AI) is now truly part of our daily lives. It gets you exclusive perks, like livestream Q&As This kind of stagnation has historically suggested that it is an industry ripe to be disrupted. The growing use of artificial intelligence in business operations and in the insurance industry may provide interesting new twists on traditional legal issues that are commonly disputed in the insurance coverage arena. With the rise of artificial intelligence, which analyzes and learns from massive sets of digital information culled from public and private sources, insurers are embracing the technologys many facets from machine learning and natural language Not only will it improve the overall customer experience, but also it can provide valuable savings by reducing labor costs, identifying fraud, and managing risk. CIECA has announced the formation of a new Standards Development Committee focused on Artificial Intelligence (AI). Loss reduction. Also, the insurance industry is going through a major transformation.

However The AI insurance use cases described in this post hold strong potential for improving operational efficiency, containing costs, and enabling insurance companies to pivot to digital-first customer experience and technology-enhanced Whereas, AI can analyze potential risks and help develop customer-specific marketing tactics. These task involve G athering information; Analyzing data by running models for example of projected sales. Artificial Intelligence in Insurance Market Share, Size, Global Industry Key Tactics, Historical Analysis, Growth, Segmentation, Application, Technology, Trends and Opportunities Forecasts to 2029 But with each passing year, the level of sophistication of AI-based Sounds hard to believe! Its time for insurers to rethink their business models and incorporate AI. Business Insurance. New specially tailored products will attract more customers at lower prices. Barring any fantastic scenarios, AI will likely remain a partner for insurance agents rather than their replacement. This can be done when artificial intelligence scans volumes of 2018 literature. While the concept might still seem somewhat futuristic, artificial intelligence (AI) is now truly part of our daily lives. It gets you exclusive perks, like livestream Q&As This kind of stagnation has historically suggested that it is an industry ripe to be disrupted. The growing use of artificial intelligence in business operations and in the insurance industry may provide interesting new twists on traditional legal issues that are commonly disputed in the insurance coverage arena. With the rise of artificial intelligence, which analyzes and learns from massive sets of digital information culled from public and private sources, insurers are embracing the technologys many facets from machine learning and natural language Not only will it improve the overall customer experience, but also it can provide valuable savings by reducing labor costs, identifying fraud, and managing risk. CIECA has announced the formation of a new Standards Development Committee focused on Artificial Intelligence (AI). Loss reduction. Also, the insurance industry is going through a major transformation.

It helps better engage with the audience, facilitate sales, and optimize operational time & cost. However, the industry certainly views AI as a game-changer in terms of faster data processing, smarter operations, and improved customer experiences. AI and the customer experience. Whether we talk about retail, hospitality or healthcare, AI has driven exponential growth in each industry. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. The first expense an insurer faces is loss. UBS client services are known for their strict bankclient confidentiality and culture The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process. The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT). Insurance is a highly regulated industry, and due to this factor, insurance companies have been slow in adapting to the new technological changes as compared to other industries. Strict regulation, outdated business practices, and other factors have made insurance companies slow to adopt marketing automation and other Insurtech.

It helps better engage with the audience, facilitate sales, and optimize operational time & cost. However, the industry certainly views AI as a game-changer in terms of faster data processing, smarter operations, and improved customer experiences. AI and the customer experience. Whether we talk about retail, hospitality or healthcare, AI has driven exponential growth in each industry. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. The first expense an insurer faces is loss. UBS client services are known for their strict bankclient confidentiality and culture The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process. The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT). Insurance is a highly regulated industry, and due to this factor, insurance companies have been slow in adapting to the new technological changes as compared to other industries. Strict regulation, outdated business practices, and other factors have made insurance companies slow to adopt marketing automation and other Insurtech.

Moreover, it makes the policyholders life easier by streamlining the customer experience, taking less effort to choose and manage insurance products. The insurance agency is notorious for its outdated processes. The Artificial Intelligence in Insurance Market Forecast Report provides details analysis of Artificial Intelligence in Insurance Professional industry which will accelerate your business. Issue: Artificial intelligence (AI) is a technology which enables computer systems to accomplish tasks that typically require a human's intelligent behavior. AI and Insurance. How technological advancements is changing the dynamics of Global Artificial Intelligence Chipsets Market overview.

AI and Insurance. How technological advancements is changing the dynamics of Global Artificial Intelligence Chipsets Market overview.

From claims document processing to improving repair cost estimating, the increased volume of data captured by artificial intelligence has increased deep learning within the insurance industry. UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland.Co-headquartered in the cities of Zrich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. Artificial intelligence (AI) is a technology that enables computer systems to accomplish tasks that would normally require human interaction. Hint: single-payer wont fix Americas health care spending.

From claims document processing to improving repair cost estimating, the increased volume of data captured by artificial intelligence has increased deep learning within the insurance industry. UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland.Co-headquartered in the cities of Zrich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. Artificial intelligence (AI) is a technology that enables computer systems to accomplish tasks that would normally require human interaction. Hint: single-payer wont fix Americas health care spending.

Help us make more ambitious videos by joining the Vox Video Lab. July 29, 2020. In such a competitive environment, many insurers are restricted to paper-based infrastructures and legacy IT implementation thus limiting their ability to make

Help us make more ambitious videos by joining the Vox Video Lab. July 29, 2020. In such a competitive environment, many insurers are restricted to paper-based infrastructures and legacy IT implementation thus limiting their ability to make  Launched in 2012, it handles the claims through an in-app chatbot. Fraud analytics The claims expenditure for insurance companies is predicted to go up by 10 percent, and up to a billion are expected to be added to their fraud-related costs. However, the silver lining is that it has reinforced the importance of technology more firmly, especially Artificial Intelligence (AI) and Cloud Computing for this specific sector.. AI has made a lot of positive changes throughout the insurance industry. What is the need for Artificial Intelligence in the Insurance Industry? 7 minute read; Up next. AI technologies such as machine learning and deep learning, machine vision, natural language processing (NLP) and robotic automation have the potential to reimagine the complete insurance lifecycle from customer procurement to claims processing. This 02 Improved Service. How Artificial Intelligence Is Reshaping the Insurance IndustryRisk Assessment and Underwriting. The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process.Personalised Offering. Today, it has become imperative that the insurance company becomes an integral part of the user's life so that it can offer the user customised journeys.Availability. But insurtech companies can connect the potential of the AI data streams available. Artificial Intelligence (AI) is a computer-assisted anal ytical course that attempts to form automated systems which can be. Artificial Intelligence (AI) in the insurance industry i s a form of technology that allows computer systems to accomplish task s without human intervention. There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. MINNEAPOLIS and RESTON, Va., July 28, 2022 (GLOBE NEWSWIRE) -- CloudCover, the company responsible for the new market category of end-to-end cybersecurity network technology and insurance, and Carahsoft Technology Corp., The Trusted Government IT Solutions Provider, today announced a partnership.

Launched in 2012, it handles the claims through an in-app chatbot. Fraud analytics The claims expenditure for insurance companies is predicted to go up by 10 percent, and up to a billion are expected to be added to their fraud-related costs. However, the silver lining is that it has reinforced the importance of technology more firmly, especially Artificial Intelligence (AI) and Cloud Computing for this specific sector.. AI has made a lot of positive changes throughout the insurance industry. What is the need for Artificial Intelligence in the Insurance Industry? 7 minute read; Up next. AI technologies such as machine learning and deep learning, machine vision, natural language processing (NLP) and robotic automation have the potential to reimagine the complete insurance lifecycle from customer procurement to claims processing. This 02 Improved Service. How Artificial Intelligence Is Reshaping the Insurance IndustryRisk Assessment and Underwriting. The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process.Personalised Offering. Today, it has become imperative that the insurance company becomes an integral part of the user's life so that it can offer the user customised journeys.Availability. But insurtech companies can connect the potential of the AI data streams available. Artificial Intelligence (AI) is a computer-assisted anal ytical course that attempts to form automated systems which can be. Artificial Intelligence (AI) in the insurance industry i s a form of technology that allows computer systems to accomplish task s without human intervention. There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. MINNEAPOLIS and RESTON, Va., July 28, 2022 (GLOBE NEWSWIRE) -- CloudCover, the company responsible for the new market category of end-to-end cybersecurity network technology and insurance, and Carahsoft Technology Corp., The Trusted Government IT Solutions Provider, today announced a partnership.  Heres a look at how AI-driven UBI might impact the industry. Technology and new data sources are changing our economy and society fundamentally, and promise to transform the insurance industry as well. Risk Assessment and Underwriting. AI in the insurance industry can use a mountain of accumulated data to create more flexible solutions. Washington (August 20, 2020) On August 14, 2020, members of the National Association of Insurance Commissioners (NAIC) unanimously adopted guiding principles on artificial intelligence (AI) emphasizing the importance of accountability, compliance, transparency, and safe, secure and robust outputs. Current AI Applications in Insurance. Dec 13, 2019 Process automation AI authenticity. powered by i 2 k Connect. AI is already becoming a disruptive force in the insurance industry by allowing companies to automate services like claims management, customer service, and document creation. Artificial Intelligence can make insurance more pleasant and affordable. Brad Nevins has over 35 years of experience marketing, premium finance and claims in the Property & Casualty insurance industry. 5 hours ago The pandemic has impacted every industry in one way or the other. The insurance industry has many opportunities to take advantage of Artificial Intelligence (AI). The combination of different technologies (automation, artificial intelligence, internet of things, big data, and blockchain) is allowing the development of innovative solutions that create value When performed manually, these services are time-consuming and often rife with human errors. Insurers have big ambitions for artificial intelligence (AI), which we define as computer systems that can sense their environment, then think, learn and take action in response. #insuranceinnovation #insurance. Frauds are becoming more and more sophisticated AI in Underwriting Evaluate Risk and Underwrite Policies More Accurately. AI performs some functions better than people, but insurance remains a personalized industry that requires human perception and judgment. Adopting artificial intelligence in the routine activities of the insurance industry would bring four benefits: 1. The Impact of Artificial Intelligence on the Insurance Industry. Insurance Quotes. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. Application of Artificial Intelligence in the insurance industry will change the way companies carry their business. All industry stakeholders, including CIECA and non-CIECA members, are invited to join. Artificial Intelligence and Insurance Industry Living in a digital era, the insurance companies are benefitting from artificial intelligence to gain more momentum. Artificial intelligence is quickly becoming a staple in the insurance industry. One of the topics that insurance and InsurTechs managers expect to achieve an enormous boost in efficiency is artificial intelligence and machine learning in particular. The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Here's how machine learning is changing the underwriting process. Artificial intelligence (AI) is playing an increasingly important role in the insurance industry. In this report we include applications that affect care delivery, including both how existing tasks are performed and how they are disrupted by changing healthcare needs or the processes required to address them, says McKinsey.. We also include applications that enhance and improve healthcare delivery, referred to as Loss reduction. 7 hours ago An earlier LexisNexis paper, Hype or Reality: The State of Artificial Intelligence and Machine Learning in the Insurance Industry, found that 16 of the top 20 insurance companies were major adopters of AI and machine learning (ML).

Heres a look at how AI-driven UBI might impact the industry. Technology and new data sources are changing our economy and society fundamentally, and promise to transform the insurance industry as well. Risk Assessment and Underwriting. AI in the insurance industry can use a mountain of accumulated data to create more flexible solutions. Washington (August 20, 2020) On August 14, 2020, members of the National Association of Insurance Commissioners (NAIC) unanimously adopted guiding principles on artificial intelligence (AI) emphasizing the importance of accountability, compliance, transparency, and safe, secure and robust outputs. Current AI Applications in Insurance. Dec 13, 2019 Process automation AI authenticity. powered by i 2 k Connect. AI is already becoming a disruptive force in the insurance industry by allowing companies to automate services like claims management, customer service, and document creation. Artificial Intelligence can make insurance more pleasant and affordable. Brad Nevins has over 35 years of experience marketing, premium finance and claims in the Property & Casualty insurance industry. 5 hours ago The pandemic has impacted every industry in one way or the other. The insurance industry has many opportunities to take advantage of Artificial Intelligence (AI). The combination of different technologies (automation, artificial intelligence, internet of things, big data, and blockchain) is allowing the development of innovative solutions that create value When performed manually, these services are time-consuming and often rife with human errors. Insurers have big ambitions for artificial intelligence (AI), which we define as computer systems that can sense their environment, then think, learn and take action in response. #insuranceinnovation #insurance. Frauds are becoming more and more sophisticated AI in Underwriting Evaluate Risk and Underwrite Policies More Accurately. AI performs some functions better than people, but insurance remains a personalized industry that requires human perception and judgment. Adopting artificial intelligence in the routine activities of the insurance industry would bring four benefits: 1. The Impact of Artificial Intelligence on the Insurance Industry. Insurance Quotes. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. Application of Artificial Intelligence in the insurance industry will change the way companies carry their business. All industry stakeholders, including CIECA and non-CIECA members, are invited to join. Artificial Intelligence and Insurance Industry Living in a digital era, the insurance companies are benefitting from artificial intelligence to gain more momentum. Artificial intelligence is quickly becoming a staple in the insurance industry. One of the topics that insurance and InsurTechs managers expect to achieve an enormous boost in efficiency is artificial intelligence and machine learning in particular. The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Here's how machine learning is changing the underwriting process. Artificial intelligence (AI) is playing an increasingly important role in the insurance industry. In this report we include applications that affect care delivery, including both how existing tasks are performed and how they are disrupted by changing healthcare needs or the processes required to address them, says McKinsey.. We also include applications that enhance and improve healthcare delivery, referred to as Loss reduction. 7 hours ago An earlier LexisNexis paper, Hype or Reality: The State of Artificial Intelligence and Machine Learning in the Insurance Industry, found that 16 of the top 20 insurance companies were major adopters of AI and machine learning (ML).

The result is an improved customer service experience and increased profitability. The technology will not only improve the customer experience but also aid insurance Artificial Intelligence in the Insurance Industry. Insurance Technology allows your business to be organized, flexible, and cost effective. You can save money, time, and labor by: Implementing more efficient processes and technology to streamline your operations and increase productivity. Reduce claims associated with: Preventing injuries and There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. In the future, your clients may have the option to convert these smart contracts into actual life insurance policies. Insurance companies are facing rapid tectonic shifts in their business operations as the financial environment changes and new technological advancements are made in the insurance industry. Under the agreement, Carahsoft will serve Several insurance firms are utilizing artificial intelligence (AI) to gain a competitive advantage in today's digital world. Amongst all the industries that are witnessing a boom after conjugating with Artificial Intelligence, the insurance industry has been the oldest and perhaps the slowest to embrace technological upgrade. The Insurance industry can benefit from smart contracts along with the advancements in Artificial intelligence and machine learning technology.

The result is an improved customer service experience and increased profitability. The technology will not only improve the customer experience but also aid insurance Artificial Intelligence in the Insurance Industry. Insurance Technology allows your business to be organized, flexible, and cost effective. You can save money, time, and labor by: Implementing more efficient processes and technology to streamline your operations and increase productivity. Reduce claims associated with: Preventing injuries and There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. In the future, your clients may have the option to convert these smart contracts into actual life insurance policies. Insurance companies are facing rapid tectonic shifts in their business operations as the financial environment changes and new technological advancements are made in the insurance industry. Under the agreement, Carahsoft will serve Several insurance firms are utilizing artificial intelligence (AI) to gain a competitive advantage in today's digital world. Amongst all the industries that are witnessing a boom after conjugating with Artificial Intelligence, the insurance industry has been the oldest and perhaps the slowest to embrace technological upgrade. The Insurance industry can benefit from smart contracts along with the advancements in Artificial intelligence and machine learning technology. Artificial intelligence is likely to affect the entire landscape of insurance as we know it. AI is turning the insurance industry around. A key reason for this is the presence of a strict regulatory environment has presented significant challenges for insurers to adopt Artificial intelligence in the insurance industry. Adopting artificial intelligence in the routine activities of the insurance industry would bring four benefits: 1. Insurance companies have been utilizing smart contracts for quite some time now. As an industry, insurance has the reputation of being conservative which makes sense, given that the point of insurance is to defend against risk. Get the latest Pittsburgh local news, breaking news, sports, entertainment, weather and traffic, as well as national and international news, from the Pulitzer Prize-winning staff of the Pittsburgh Post-Gazette. These principles were established to inform Examples include gathering information, analyzing data by running a model, and making decisions. And, in a bid to cover the possibilities and challenges of inculcating artificial intelligence and machine learning in the insurance industry, we have already learned a lot in this four-part series. Strict regulation, outdated business practices, and other factors have made insurance companies slow to adopt marketing automation and other Insurtech. This failure to embrace technology leaves customers under-served and agencies Why the insurance industry needs AI solutions; What insurers are already doing in this area, and; How AI will impact the industry in the foreseeable future. 2Q2019 saw a record of $7.4B invested in AI startups, with the majority going to autonomous vehicles and healthcare-related companies. Since 2013, $66B has been invested in AI start-ups across nearly 7,000 deals, with several $100M+ mega deals in the most recent quarters.3 Chinas 2030 Planaims to build a $150B AI industry in China alone. To better understand insurance carriers perceptions and the potential benefits and challenges impacting AI and ML adoption, LexisNexis Risk Solutions surveyed more than 300 insurance professionals across the top 100 U.S. carriers within the auto, home, life and commercial markets. InsurTech companies are leveraging Artificial Intelligence (AI) to conquer more ground in todays digital world. The use of AI has increased exponentially across all industries over the past several years. Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry. Today, t he insurance market is dominated by massive national brands and legacy product lines that havent substantially evolved in decades. The advancements in Artificial Intelligence are bringing a seismic, tech-driven shift.

Here are some of them: Pricing Insurance is an industry that relies on data, and embracing technology enhances its capability to gain better knowledge about its consumers, helping them predict and offer better insurance policies. Hence, the concept of Artificial Intelligence in the Insurance industry analyzing data, anticipating results and helping with decision making is not so far fetched after all. Insurance is a $1.2 trillion industry in the U.S. alone, employing 2.9 million people. At its simplest, Artificial Intelligence (AI) is a set of computerized tools designed to achieve objectives that usually require human intelligence. Likewise, it could have a big impact on the insurance industry. Intangible assets and risks, artificial intelligence and the sharing economy: @PC_360 looks into the factors prompting accelerated innovation in the #InsuranceIndustryand what's involved in implementing it. New Jersey, NJ -- -- 07/19/2022-- The Global Artificial Intelligence (AI) in Insurance Market Report assesses developments relevant to the

Here are some of them: Pricing Insurance is an industry that relies on data, and embracing technology enhances its capability to gain better knowledge about its consumers, helping them predict and offer better insurance policies. Hence, the concept of Artificial Intelligence in the Insurance industry analyzing data, anticipating results and helping with decision making is not so far fetched after all. Insurance is a $1.2 trillion industry in the U.S. alone, employing 2.9 million people. At its simplest, Artificial Intelligence (AI) is a set of computerized tools designed to achieve objectives that usually require human intelligence. Likewise, it could have a big impact on the insurance industry. Intangible assets and risks, artificial intelligence and the sharing economy: @PC_360 looks into the factors prompting accelerated innovation in the #InsuranceIndustryand what's involved in implementing it. New Jersey, NJ -- -- 07/19/2022-- The Global Artificial Intelligence (AI) in Insurance Market Report assesses developments relevant to the  The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Blockchain-based networks can secure customer data and automate payments. This has allowed them to deploy data modeling, predictive analysis, and machine learning across the

The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Blockchain-based networks can secure customer data and automate payments. This has allowed them to deploy data modeling, predictive analysis, and machine learning across the  Given the tentative stability and natural catastrophes, insurance companies often stand on a trembling ground and confront massive challenges, even when it comes to adopting seamless and intuitive digital solutions such as Artificial Intelligence in But other areas that arent always top of mind, like insurance, have also begun to use artificial intelligence. As per a recent report, the artificial intelligence (AI) in insurance market size is valued at USD 6.92 billion by 2028 and is expected to grow at a compound annual growth rate of 24.05% in the forecast period of 2021 to 2028 ( source ). Historically, the insurance industry hasnt felt the effects of digital disruption, due to a strict regulatory environment, the scale required to create a risk portfolio, and the time needed to establish trust with customers. New York, United States, July 25, 2022 (GLOBE NEWSWIRE) -- Specialty insurance offers coverages for more risky accounts and odd, challenging, and unique insurance needs. Artificial intelligence (AI) and machine learning (ML). Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry.

Given the tentative stability and natural catastrophes, insurance companies often stand on a trembling ground and confront massive challenges, even when it comes to adopting seamless and intuitive digital solutions such as Artificial Intelligence in But other areas that arent always top of mind, like insurance, have also begun to use artificial intelligence. As per a recent report, the artificial intelligence (AI) in insurance market size is valued at USD 6.92 billion by 2028 and is expected to grow at a compound annual growth rate of 24.05% in the forecast period of 2021 to 2028 ( source ). Historically, the insurance industry hasnt felt the effects of digital disruption, due to a strict regulatory environment, the scale required to create a risk portfolio, and the time needed to establish trust with customers. New York, United States, July 25, 2022 (GLOBE NEWSWIRE) -- Specialty insurance offers coverages for more risky accounts and odd, challenging, and unique insurance needs. Artificial intelligence (AI) and machine learning (ML). Grand Rapids, MI and Pittsburgh, PA July 29, 2020 In a transformational move, Acrisure today announced that it has acquired artificial intelligence (AI) leader Tulco LLCs insurance practice to bring best-in-class data science, AI, and machine learning capabilities to the insurance brokerage industry.  But the technology faces big challenges, especially with regard to customer privacy.

But the technology faces big challenges, especially with regard to customer privacy.  However The AI insurance use cases described in this post hold strong potential for improving operational efficiency, containing costs, and enabling insurance companies to pivot to digital-first customer experience and technology-enhanced Whereas, AI can analyze potential risks and help develop customer-specific marketing tactics. These task involve G athering information; Analyzing data by running models for example of projected sales. Artificial Intelligence in Insurance Market Share, Size, Global Industry Key Tactics, Historical Analysis, Growth, Segmentation, Application, Technology, Trends and Opportunities Forecasts to 2029 But with each passing year, the level of sophistication of AI-based Sounds hard to believe! Its time for insurers to rethink their business models and incorporate AI. Business Insurance. New specially tailored products will attract more customers at lower prices. Barring any fantastic scenarios, AI will likely remain a partner for insurance agents rather than their replacement. This can be done when artificial intelligence scans volumes of 2018 literature. While the concept might still seem somewhat futuristic, artificial intelligence (AI) is now truly part of our daily lives. It gets you exclusive perks, like livestream Q&As This kind of stagnation has historically suggested that it is an industry ripe to be disrupted. The growing use of artificial intelligence in business operations and in the insurance industry may provide interesting new twists on traditional legal issues that are commonly disputed in the insurance coverage arena. With the rise of artificial intelligence, which analyzes and learns from massive sets of digital information culled from public and private sources, insurers are embracing the technologys many facets from machine learning and natural language Not only will it improve the overall customer experience, but also it can provide valuable savings by reducing labor costs, identifying fraud, and managing risk. CIECA has announced the formation of a new Standards Development Committee focused on Artificial Intelligence (AI). Loss reduction. Also, the insurance industry is going through a major transformation.

However The AI insurance use cases described in this post hold strong potential for improving operational efficiency, containing costs, and enabling insurance companies to pivot to digital-first customer experience and technology-enhanced Whereas, AI can analyze potential risks and help develop customer-specific marketing tactics. These task involve G athering information; Analyzing data by running models for example of projected sales. Artificial Intelligence in Insurance Market Share, Size, Global Industry Key Tactics, Historical Analysis, Growth, Segmentation, Application, Technology, Trends and Opportunities Forecasts to 2029 But with each passing year, the level of sophistication of AI-based Sounds hard to believe! Its time for insurers to rethink their business models and incorporate AI. Business Insurance. New specially tailored products will attract more customers at lower prices. Barring any fantastic scenarios, AI will likely remain a partner for insurance agents rather than their replacement. This can be done when artificial intelligence scans volumes of 2018 literature. While the concept might still seem somewhat futuristic, artificial intelligence (AI) is now truly part of our daily lives. It gets you exclusive perks, like livestream Q&As This kind of stagnation has historically suggested that it is an industry ripe to be disrupted. The growing use of artificial intelligence in business operations and in the insurance industry may provide interesting new twists on traditional legal issues that are commonly disputed in the insurance coverage arena. With the rise of artificial intelligence, which analyzes and learns from massive sets of digital information culled from public and private sources, insurers are embracing the technologys many facets from machine learning and natural language Not only will it improve the overall customer experience, but also it can provide valuable savings by reducing labor costs, identifying fraud, and managing risk. CIECA has announced the formation of a new Standards Development Committee focused on Artificial Intelligence (AI). Loss reduction. Also, the insurance industry is going through a major transformation.

It helps better engage with the audience, facilitate sales, and optimize operational time & cost. However, the industry certainly views AI as a game-changer in terms of faster data processing, smarter operations, and improved customer experiences. AI and the customer experience. Whether we talk about retail, hospitality or healthcare, AI has driven exponential growth in each industry. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. The first expense an insurer faces is loss. UBS client services are known for their strict bankclient confidentiality and culture The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process. The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT). Insurance is a highly regulated industry, and due to this factor, insurance companies have been slow in adapting to the new technological changes as compared to other industries. Strict regulation, outdated business practices, and other factors have made insurance companies slow to adopt marketing automation and other Insurtech.

It helps better engage with the audience, facilitate sales, and optimize operational time & cost. However, the industry certainly views AI as a game-changer in terms of faster data processing, smarter operations, and improved customer experiences. AI and the customer experience. Whether we talk about retail, hospitality or healthcare, AI has driven exponential growth in each industry. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. The first expense an insurer faces is loss. UBS client services are known for their strict bankclient confidentiality and culture The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process. The expansion in the use of AI in the insurance industry comes from the trends of increased automation, data mining of Big Data, and analysis of information retrieved from the Internet of Things (IoT). Insurance is a highly regulated industry, and due to this factor, insurance companies have been slow in adapting to the new technological changes as compared to other industries. Strict regulation, outdated business practices, and other factors have made insurance companies slow to adopt marketing automation and other Insurtech.

Moreover, it makes the policyholders life easier by streamlining the customer experience, taking less effort to choose and manage insurance products. The insurance agency is notorious for its outdated processes. The Artificial Intelligence in Insurance Market Forecast Report provides details analysis of Artificial Intelligence in Insurance Professional industry which will accelerate your business. Issue: Artificial intelligence (AI) is a technology which enables computer systems to accomplish tasks that typically require a human's intelligent behavior.

AI and Insurance. How technological advancements is changing the dynamics of Global Artificial Intelligence Chipsets Market overview.

AI and Insurance. How technological advancements is changing the dynamics of Global Artificial Intelligence Chipsets Market overview.

From claims document processing to improving repair cost estimating, the increased volume of data captured by artificial intelligence has increased deep learning within the insurance industry. UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland.Co-headquartered in the cities of Zrich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. Artificial intelligence (AI) is a technology that enables computer systems to accomplish tasks that would normally require human interaction. Hint: single-payer wont fix Americas health care spending.

From claims document processing to improving repair cost estimating, the increased volume of data captured by artificial intelligence has increased deep learning within the insurance industry. UBS Group AG is a multinational investment bank and financial services company founded and based in Switzerland.Co-headquartered in the cities of Zrich and Basel, it maintains a presence in all major financial centres as the largest Swiss banking institution and the largest private bank in the world. With premium losses routinely estimated in the billions, insurers must actively identify and minimise losses. Artificial intelligence (AI) is a technology that enables computer systems to accomplish tasks that would normally require human interaction. Hint: single-payer wont fix Americas health care spending.

Help us make more ambitious videos by joining the Vox Video Lab. July 29, 2020. In such a competitive environment, many insurers are restricted to paper-based infrastructures and legacy IT implementation thus limiting their ability to make

Help us make more ambitious videos by joining the Vox Video Lab. July 29, 2020. In such a competitive environment, many insurers are restricted to paper-based infrastructures and legacy IT implementation thus limiting their ability to make  Launched in 2012, it handles the claims through an in-app chatbot. Fraud analytics The claims expenditure for insurance companies is predicted to go up by 10 percent, and up to a billion are expected to be added to their fraud-related costs. However, the silver lining is that it has reinforced the importance of technology more firmly, especially Artificial Intelligence (AI) and Cloud Computing for this specific sector.. AI has made a lot of positive changes throughout the insurance industry. What is the need for Artificial Intelligence in the Insurance Industry? 7 minute read; Up next. AI technologies such as machine learning and deep learning, machine vision, natural language processing (NLP) and robotic automation have the potential to reimagine the complete insurance lifecycle from customer procurement to claims processing. This 02 Improved Service. How Artificial Intelligence Is Reshaping the Insurance IndustryRisk Assessment and Underwriting. The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process.Personalised Offering. Today, it has become imperative that the insurance company becomes an integral part of the user's life so that it can offer the user customised journeys.Availability. But insurtech companies can connect the potential of the AI data streams available. Artificial Intelligence (AI) is a computer-assisted anal ytical course that attempts to form automated systems which can be. Artificial Intelligence (AI) in the insurance industry i s a form of technology that allows computer systems to accomplish task s without human intervention. There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. MINNEAPOLIS and RESTON, Va., July 28, 2022 (GLOBE NEWSWIRE) -- CloudCover, the company responsible for the new market category of end-to-end cybersecurity network technology and insurance, and Carahsoft Technology Corp., The Trusted Government IT Solutions Provider, today announced a partnership.

Launched in 2012, it handles the claims through an in-app chatbot. Fraud analytics The claims expenditure for insurance companies is predicted to go up by 10 percent, and up to a billion are expected to be added to their fraud-related costs. However, the silver lining is that it has reinforced the importance of technology more firmly, especially Artificial Intelligence (AI) and Cloud Computing for this specific sector.. AI has made a lot of positive changes throughout the insurance industry. What is the need for Artificial Intelligence in the Insurance Industry? 7 minute read; Up next. AI technologies such as machine learning and deep learning, machine vision, natural language processing (NLP) and robotic automation have the potential to reimagine the complete insurance lifecycle from customer procurement to claims processing. This 02 Improved Service. How Artificial Intelligence Is Reshaping the Insurance IndustryRisk Assessment and Underwriting. The main thing that AI is reshaping in the insurance industry is the risk assessment and underwriting process.Personalised Offering. Today, it has become imperative that the insurance company becomes an integral part of the user's life so that it can offer the user customised journeys.Availability. But insurtech companies can connect the potential of the AI data streams available. Artificial Intelligence (AI) is a computer-assisted anal ytical course that attempts to form automated systems which can be. Artificial Intelligence (AI) in the insurance industry i s a form of technology that allows computer systems to accomplish task s without human intervention. There is no doubt that new technologies and digital platforms are changing the insurance industry, changing the value chain from underwriting and customer service to claims. MINNEAPOLIS and RESTON, Va., July 28, 2022 (GLOBE NEWSWIRE) -- CloudCover, the company responsible for the new market category of end-to-end cybersecurity network technology and insurance, and Carahsoft Technology Corp., The Trusted Government IT Solutions Provider, today announced a partnership.  Heres a look at how AI-driven UBI might impact the industry. Technology and new data sources are changing our economy and society fundamentally, and promise to transform the insurance industry as well. Risk Assessment and Underwriting. AI in the insurance industry can use a mountain of accumulated data to create more flexible solutions. Washington (August 20, 2020) On August 14, 2020, members of the National Association of Insurance Commissioners (NAIC) unanimously adopted guiding principles on artificial intelligence (AI) emphasizing the importance of accountability, compliance, transparency, and safe, secure and robust outputs. Current AI Applications in Insurance. Dec 13, 2019 Process automation AI authenticity. powered by i 2 k Connect. AI is already becoming a disruptive force in the insurance industry by allowing companies to automate services like claims management, customer service, and document creation. Artificial Intelligence can make insurance more pleasant and affordable. Brad Nevins has over 35 years of experience marketing, premium finance and claims in the Property & Casualty insurance industry. 5 hours ago The pandemic has impacted every industry in one way or the other. The insurance industry has many opportunities to take advantage of Artificial Intelligence (AI). The combination of different technologies (automation, artificial intelligence, internet of things, big data, and blockchain) is allowing the development of innovative solutions that create value When performed manually, these services are time-consuming and often rife with human errors. Insurers have big ambitions for artificial intelligence (AI), which we define as computer systems that can sense their environment, then think, learn and take action in response. #insuranceinnovation #insurance. Frauds are becoming more and more sophisticated AI in Underwriting Evaluate Risk and Underwrite Policies More Accurately. AI performs some functions better than people, but insurance remains a personalized industry that requires human perception and judgment. Adopting artificial intelligence in the routine activities of the insurance industry would bring four benefits: 1. The Impact of Artificial Intelligence on the Insurance Industry. Insurance Quotes. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. Application of Artificial Intelligence in the insurance industry will change the way companies carry their business. All industry stakeholders, including CIECA and non-CIECA members, are invited to join. Artificial Intelligence and Insurance Industry Living in a digital era, the insurance companies are benefitting from artificial intelligence to gain more momentum. Artificial intelligence is quickly becoming a staple in the insurance industry. One of the topics that insurance and InsurTechs managers expect to achieve an enormous boost in efficiency is artificial intelligence and machine learning in particular. The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Here's how machine learning is changing the underwriting process. Artificial intelligence (AI) is playing an increasingly important role in the insurance industry. In this report we include applications that affect care delivery, including both how existing tasks are performed and how they are disrupted by changing healthcare needs or the processes required to address them, says McKinsey.. We also include applications that enhance and improve healthcare delivery, referred to as Loss reduction. 7 hours ago An earlier LexisNexis paper, Hype or Reality: The State of Artificial Intelligence and Machine Learning in the Insurance Industry, found that 16 of the top 20 insurance companies were major adopters of AI and machine learning (ML).

Heres a look at how AI-driven UBI might impact the industry. Technology and new data sources are changing our economy and society fundamentally, and promise to transform the insurance industry as well. Risk Assessment and Underwriting. AI in the insurance industry can use a mountain of accumulated data to create more flexible solutions. Washington (August 20, 2020) On August 14, 2020, members of the National Association of Insurance Commissioners (NAIC) unanimously adopted guiding principles on artificial intelligence (AI) emphasizing the importance of accountability, compliance, transparency, and safe, secure and robust outputs. Current AI Applications in Insurance. Dec 13, 2019 Process automation AI authenticity. powered by i 2 k Connect. AI is already becoming a disruptive force in the insurance industry by allowing companies to automate services like claims management, customer service, and document creation. Artificial Intelligence can make insurance more pleasant and affordable. Brad Nevins has over 35 years of experience marketing, premium finance and claims in the Property & Casualty insurance industry. 5 hours ago The pandemic has impacted every industry in one way or the other. The insurance industry has many opportunities to take advantage of Artificial Intelligence (AI). The combination of different technologies (automation, artificial intelligence, internet of things, big data, and blockchain) is allowing the development of innovative solutions that create value When performed manually, these services are time-consuming and often rife with human errors. Insurers have big ambitions for artificial intelligence (AI), which we define as computer systems that can sense their environment, then think, learn and take action in response. #insuranceinnovation #insurance. Frauds are becoming more and more sophisticated AI in Underwriting Evaluate Risk and Underwrite Policies More Accurately. AI performs some functions better than people, but insurance remains a personalized industry that requires human perception and judgment. Adopting artificial intelligence in the routine activities of the insurance industry would bring four benefits: 1. The Impact of Artificial Intelligence on the Insurance Industry. Insurance Quotes. A rtificial intelligence (AI) is rapidly becoming an important technology in the insurance industry, as firms and their regulators investigate its potential and come to grips with its risks. Application of Artificial Intelligence in the insurance industry will change the way companies carry their business. All industry stakeholders, including CIECA and non-CIECA members, are invited to join. Artificial Intelligence and Insurance Industry Living in a digital era, the insurance companies are benefitting from artificial intelligence to gain more momentum. Artificial intelligence is quickly becoming a staple in the insurance industry. One of the topics that insurance and InsurTechs managers expect to achieve an enormous boost in efficiency is artificial intelligence and machine learning in particular. The adoption of marketing automation and artificial intelligence in the insurance industry is lagging among other industries. Here's how machine learning is changing the underwriting process. Artificial intelligence (AI) is playing an increasingly important role in the insurance industry. In this report we include applications that affect care delivery, including both how existing tasks are performed and how they are disrupted by changing healthcare needs or the processes required to address them, says McKinsey.. We also include applications that enhance and improve healthcare delivery, referred to as Loss reduction. 7 hours ago An earlier LexisNexis paper, Hype or Reality: The State of Artificial Intelligence and Machine Learning in the Insurance Industry, found that 16 of the top 20 insurance companies were major adopters of AI and machine learning (ML).